For younger consumers, customized beauty formulas and packaging are incredibly appealing. The vast array of products available online can make finding the right one frustrating and time-consuming. This report, featuring zero-party consumer data and expert opinions, explores how the desire for personalized beauty is driving significant interest in custom beauty products among younger consumers.

For younger consumers, customized beauty formulas and packaging are incredibly appealing. The vast array of products available online can make finding the right one frustrating and time-consuming. This report, featuring zero-party consumer data and expert opinions, explores how the desire for personalized beauty is driving significant interest in custom beauty products among younger consumers.

Brought to you by

For younger consumers, customized beauty formulas and packaging are incredibly appealing. The vast array of products available online can make finding the right one frustrating and time-consuming. This report, featuring zero-party consumer data from 613 youths and expert opinions, explores how the desire for personalized beauty is driving significant interest in custom beauty products among younger consumers.

Brought to you by

Authors: Onanma Okeke, Saloni Bonde, Wendy Qian, Noemi Morales, and Mary Ngo

Brought to you by

Corvane is an AI-powered consumer and market intelligence platform that empowers you to create brands, ads, products, and shopping experiences that people love. Our commitment extends to providing our research and ad-testing proprietary platform built from the ground up.

BeautyMatter is an essential daily resource for industry insiders who demand the most current beauty intelligence. BeautyMatter fills the void, connects the dots, and provides a perspective that is informed, analytical, and with a compelling point of view. We help leaders stay connected and informed in a constantly changing world.

Introduction

Consumers now have the opportunity to participate in creating products uniquely tailored to meet their individual needs and preferences. This gravitation towards more customer-based solutions allows consumers to be a part of the process, increasing their attachment to the products they help create. The beauty industry is undergoing a shift towards personalization, driven by the evolving preferences of the younger generation. As technology advances and consumer expectations change, the future of beauty is becoming increasingly personal. This report explores the trends, drivers, and implications of this transformation using zero-party data from 613 individuals in the USA aged 18-31. Is the future of beauty personal?

Market Shifts: The beauty industry is adapting to meet the demand for personalized products, influencer marketing and product development strategies. In a world where most things are mass-produced, individualism is becoming increasingly important.

Sustainability: Customized products can reduce waste, appeals to environmental concerns amidst climate crisis.

Consumer Involvement: When customers are involved in the process, they develop a stronger attachment to the product, which becomes a reflection of their own identity. This is especially significant in a market characterized by fast product cycles and the impersonal nature of mass production. Personalized beauty is not just a trend; it is a fundamental shift in how products are created, marketed, and consumed. Young consumers are seeking products tailored to their unique needs, preferences, and identities. This demand for customization is reshaping the industry, pushing brands to innovate and adopt new technologies to stay relevant.

Embracing Diversity: The beauty industry is evolving to address diverse, previously unmet consumer needs. Product diversity and inclusivity are now crucial, encompassing various skin colors, hair types, and specific conditions. This broader representation validates consumers across different demographics, fostering a sense of acknowledgment and belonging. As a result, inclusivity has become both an ethical imperative and a key factor in brand success.

The beauty industry is experiencing a significant transformation driven by the demands of younger consumers, particularly Gen Z. These consumers are seeking highly personalized and unique experiences across skincare, makeup, and haircare, actively participating in the co-creation of products tailored to their specific needs and preferences. This shift towards customization and active consumer involvement is being facilitated by technological advancements, enabling brands to offer increasingly personalized solutions. As a result, the future of beauty is becoming more individualized, with tech-driven personalization at its core. This is reshaping various aspects of the industry, from product development and marketing strategies to retail experiences and brand loyalty. Companies are likely to adopt more flexible production processes, interactive marketing approaches, and data-driven personalization techniques to meet these evolving consumer expectations. The movement towards personalization not only presents challenges for beauty brands but also offers significant opportunities for those able to successfully adapt to this new landscape, potentially gaining a competitive edge in the market.

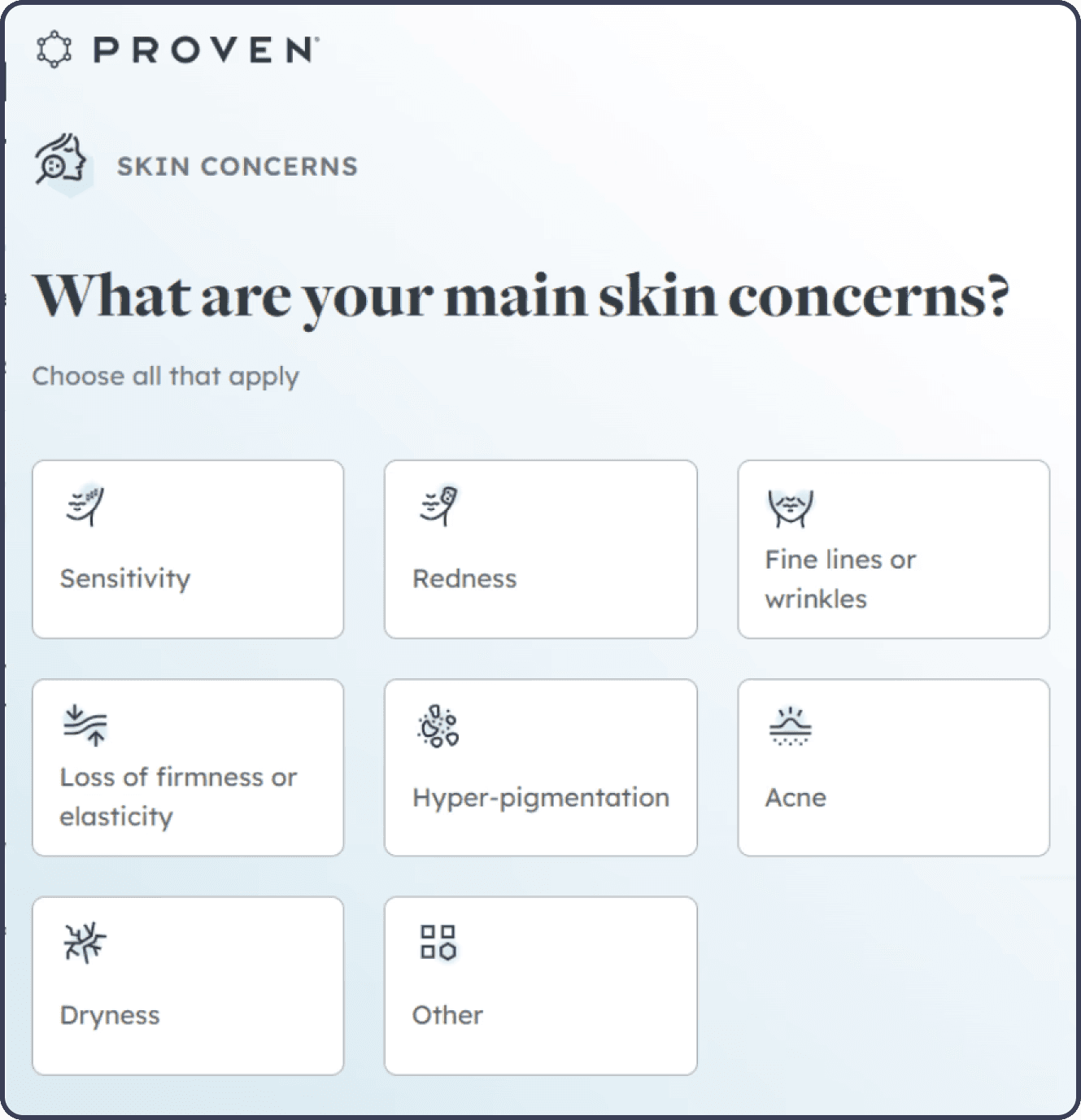

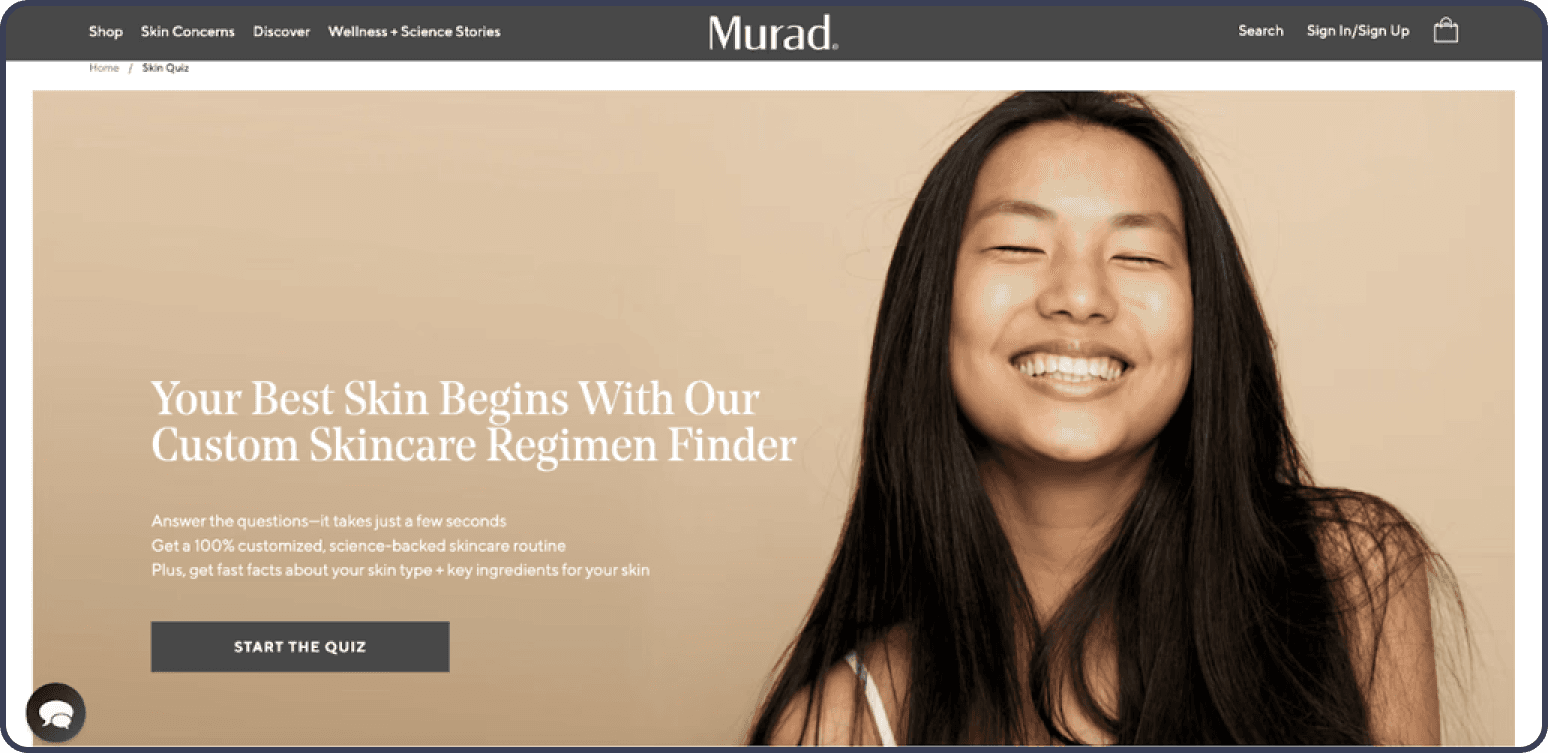

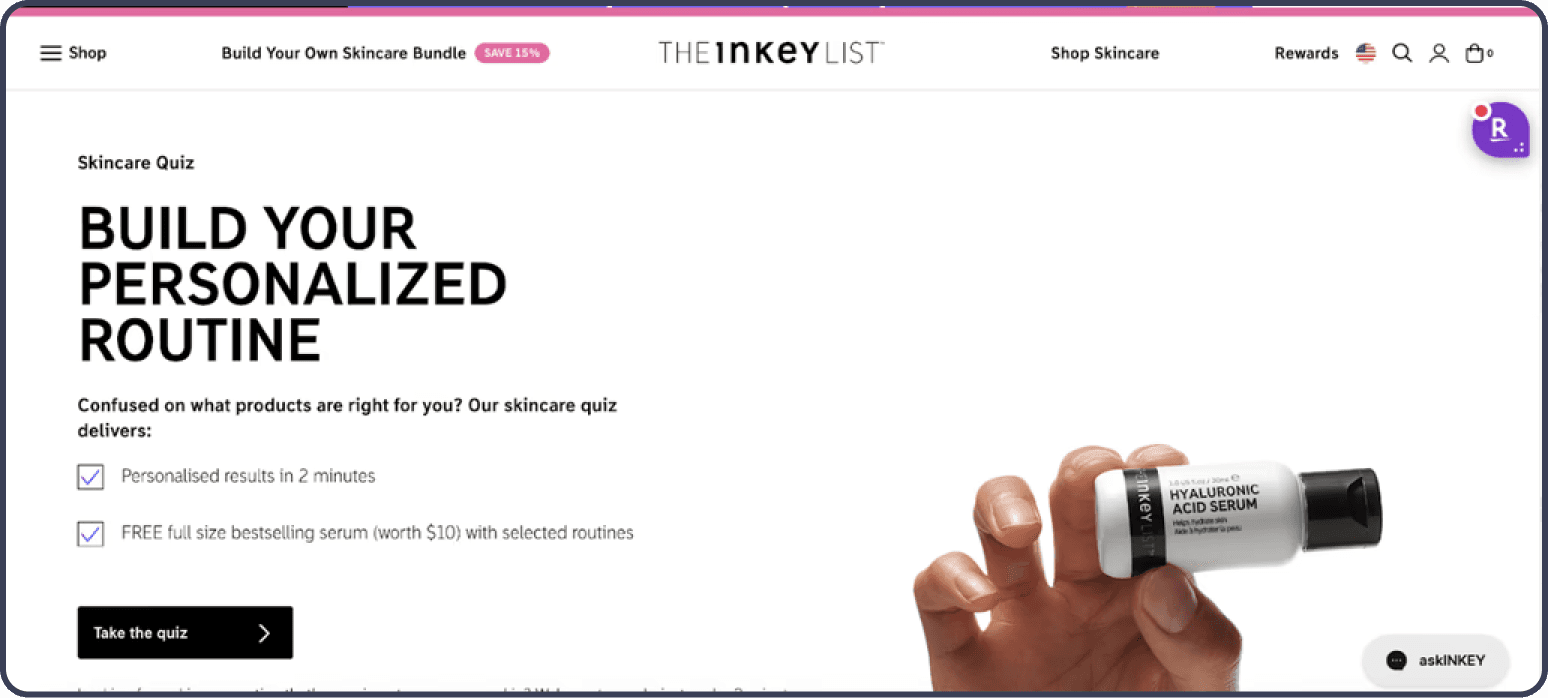

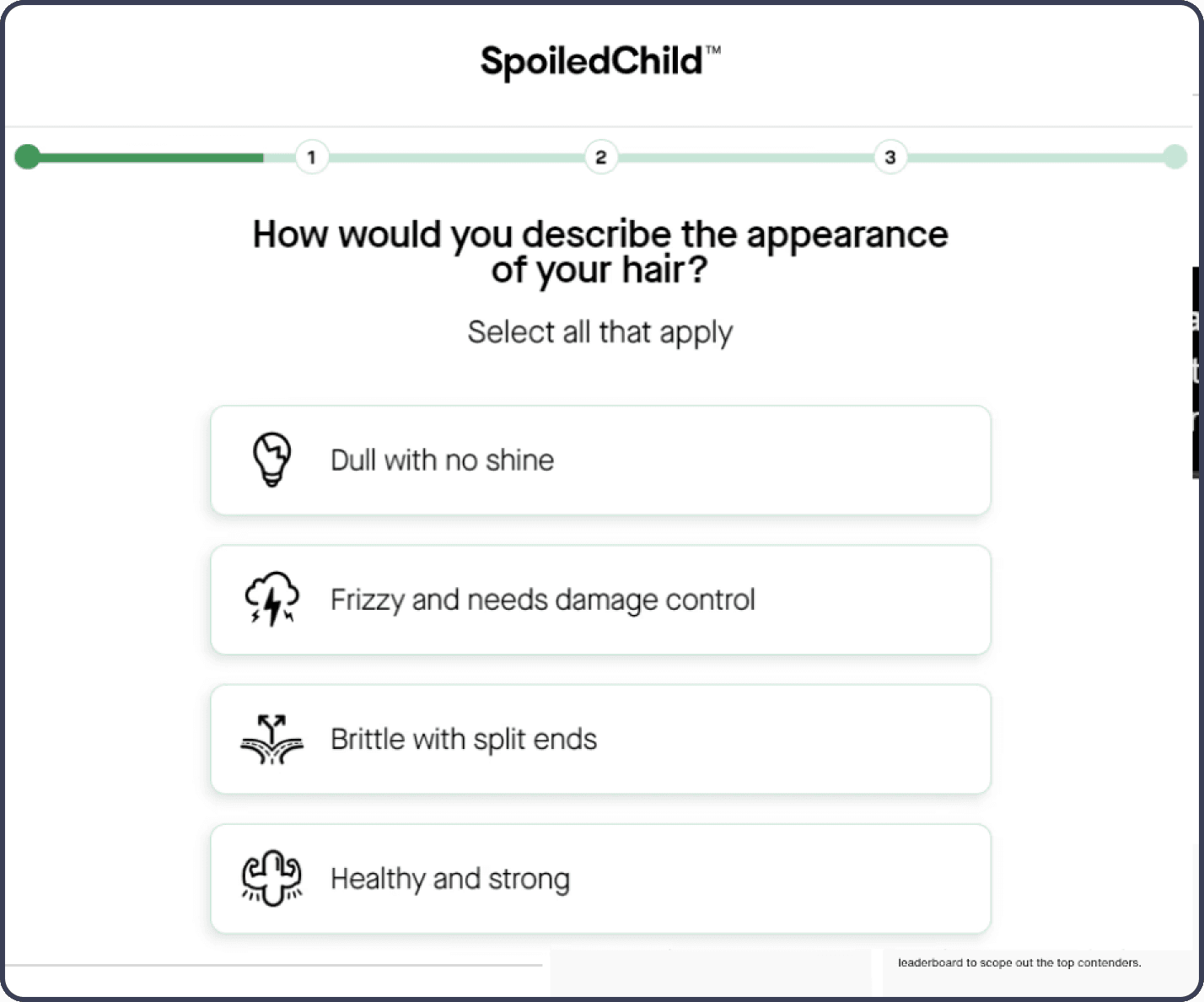

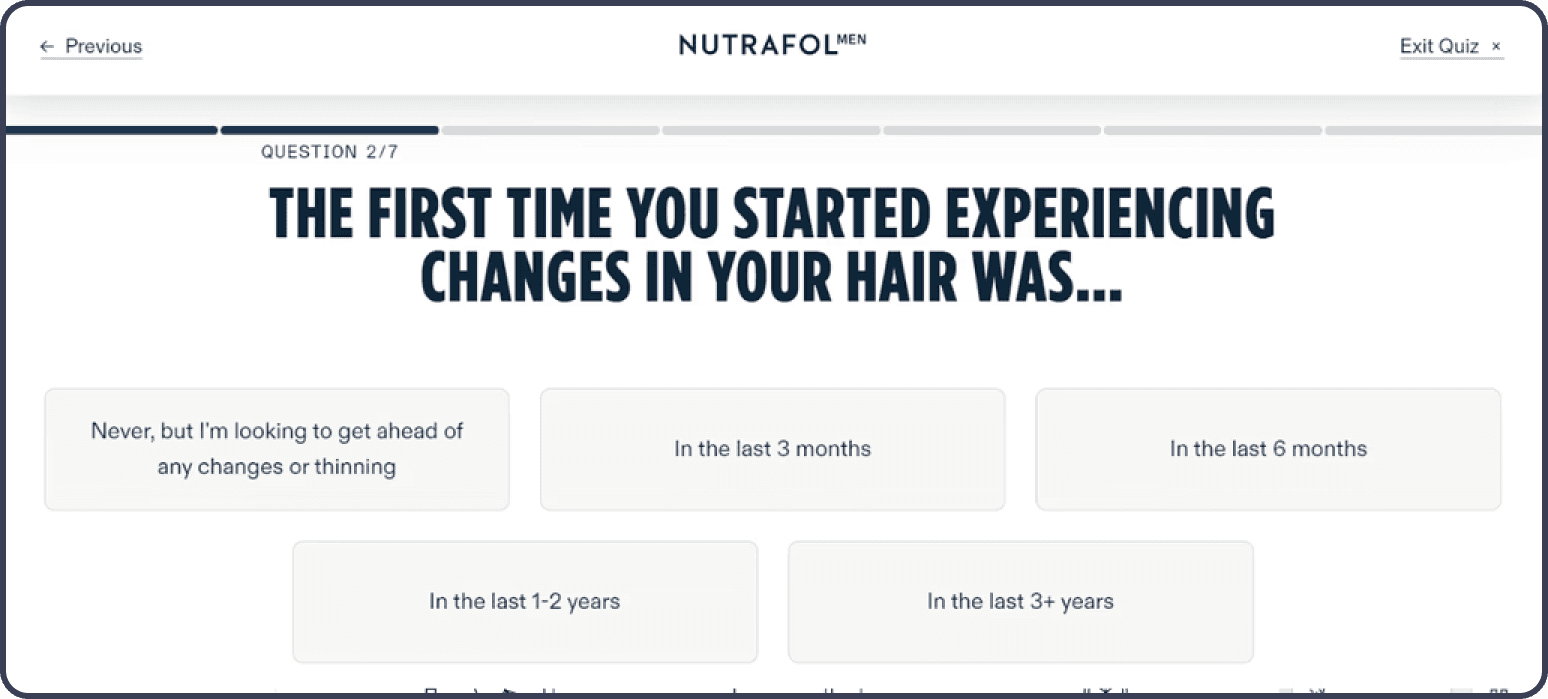

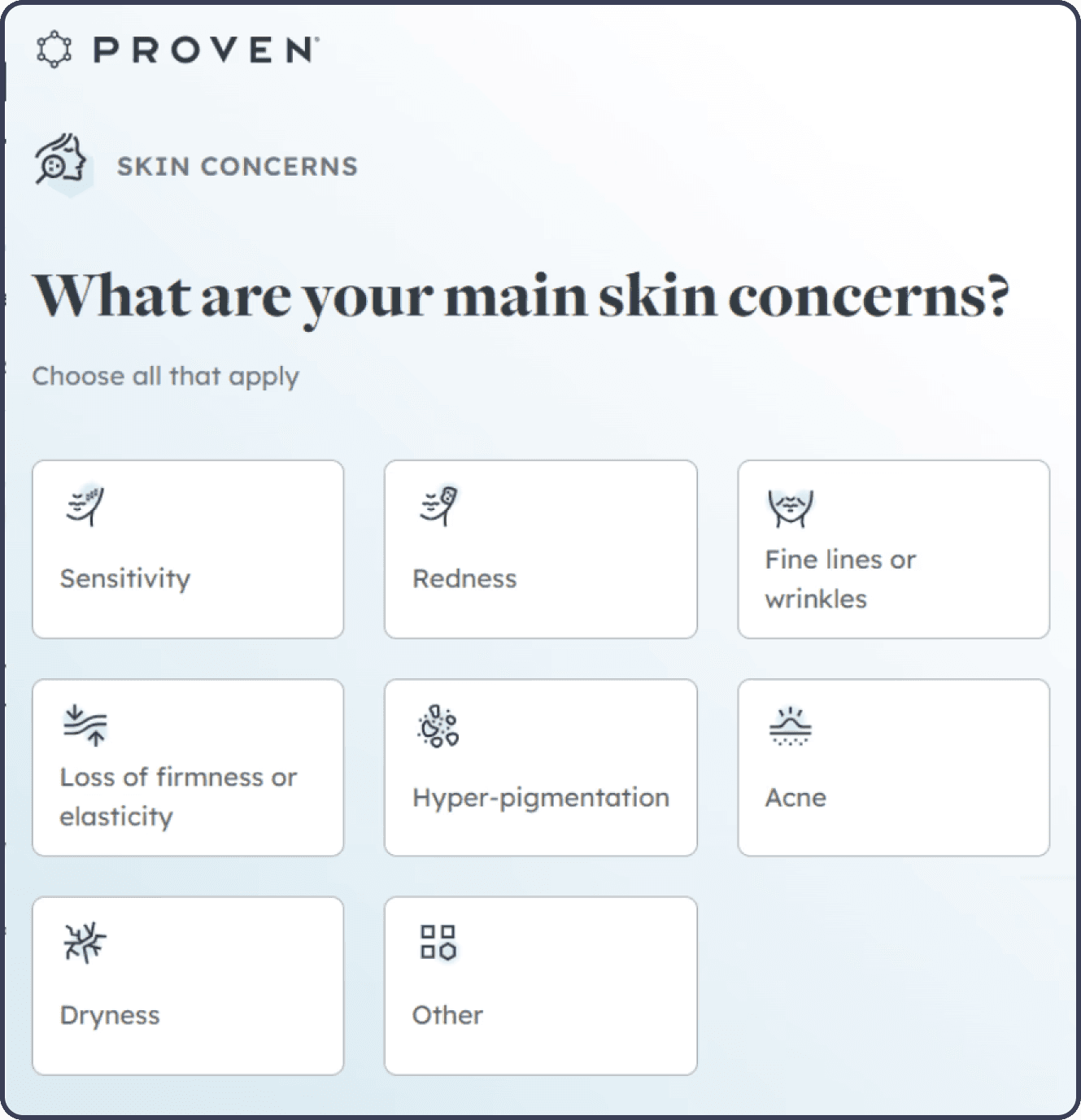

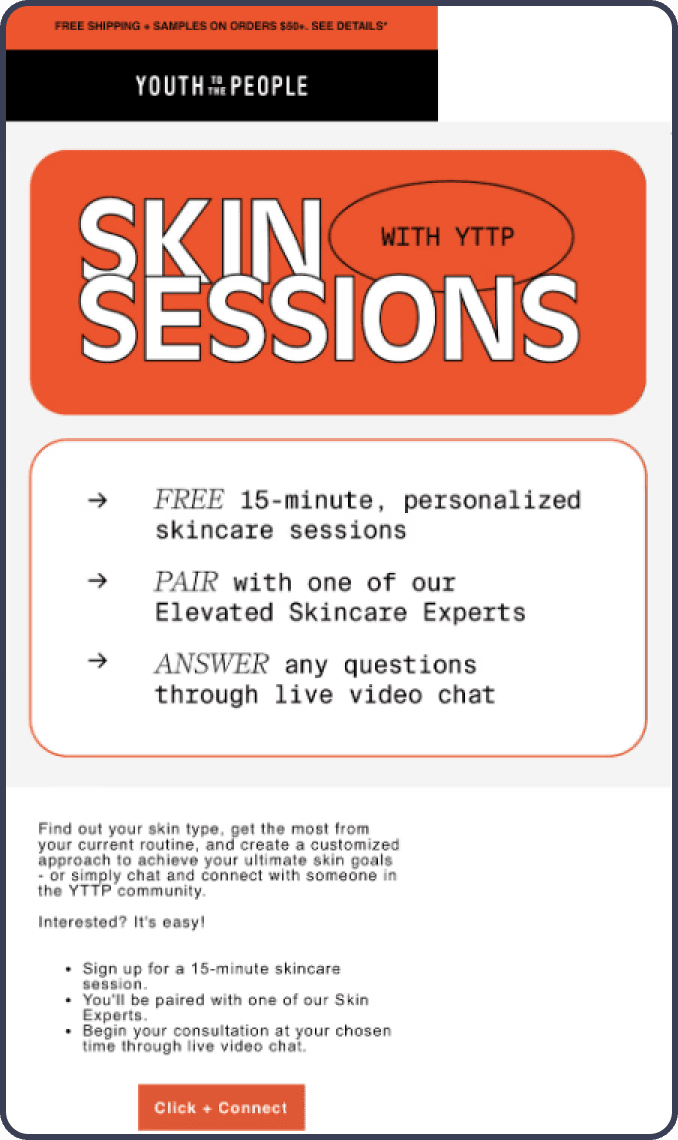

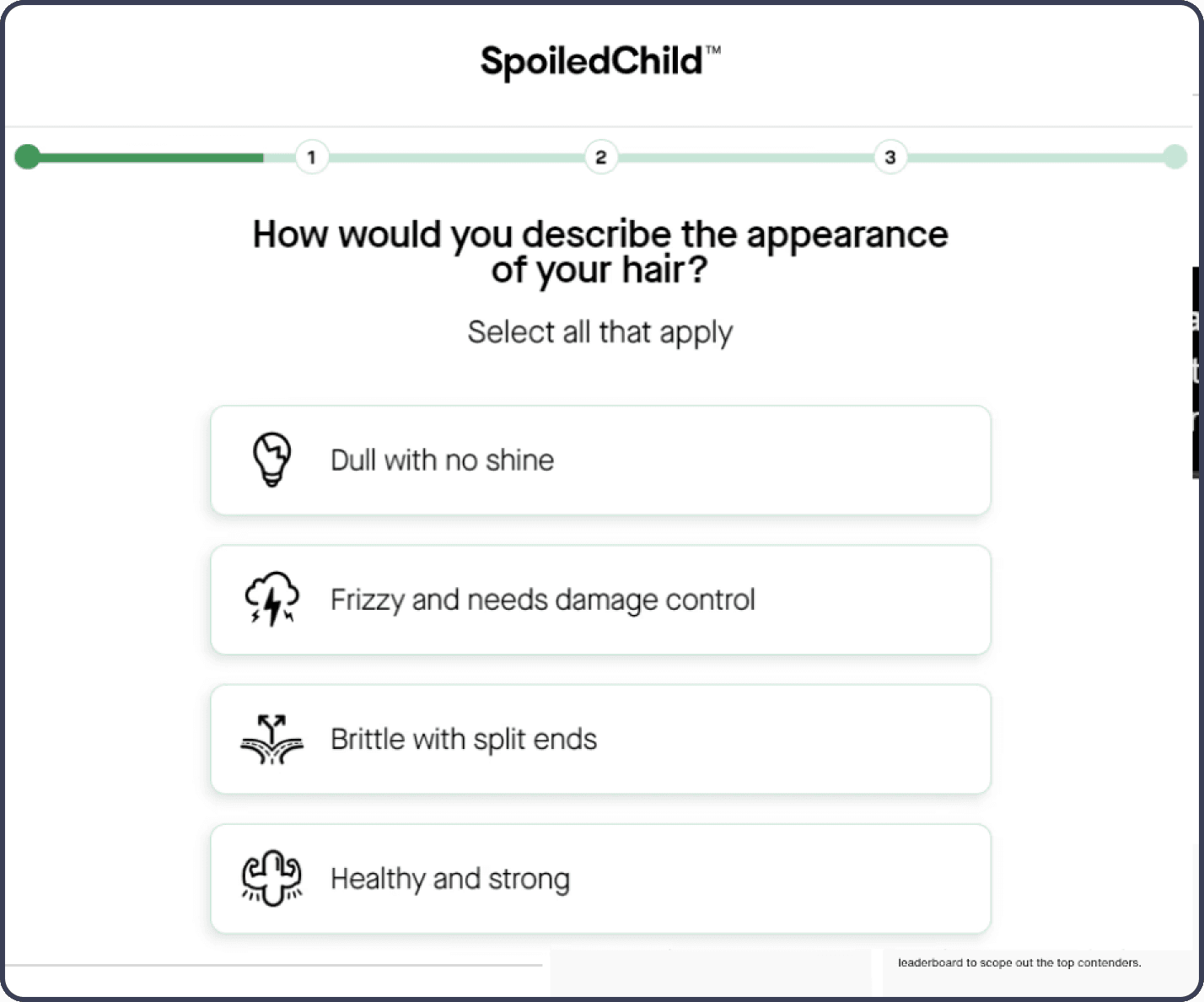

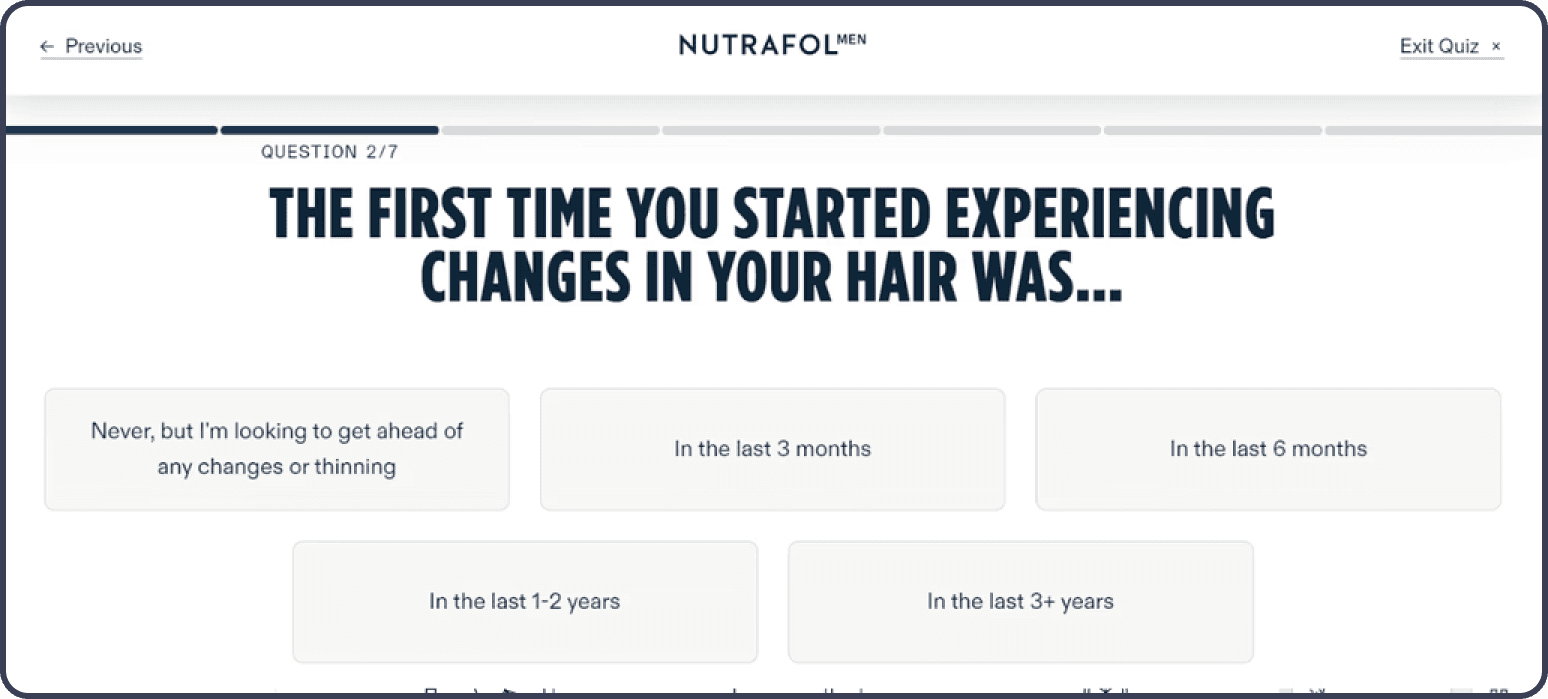

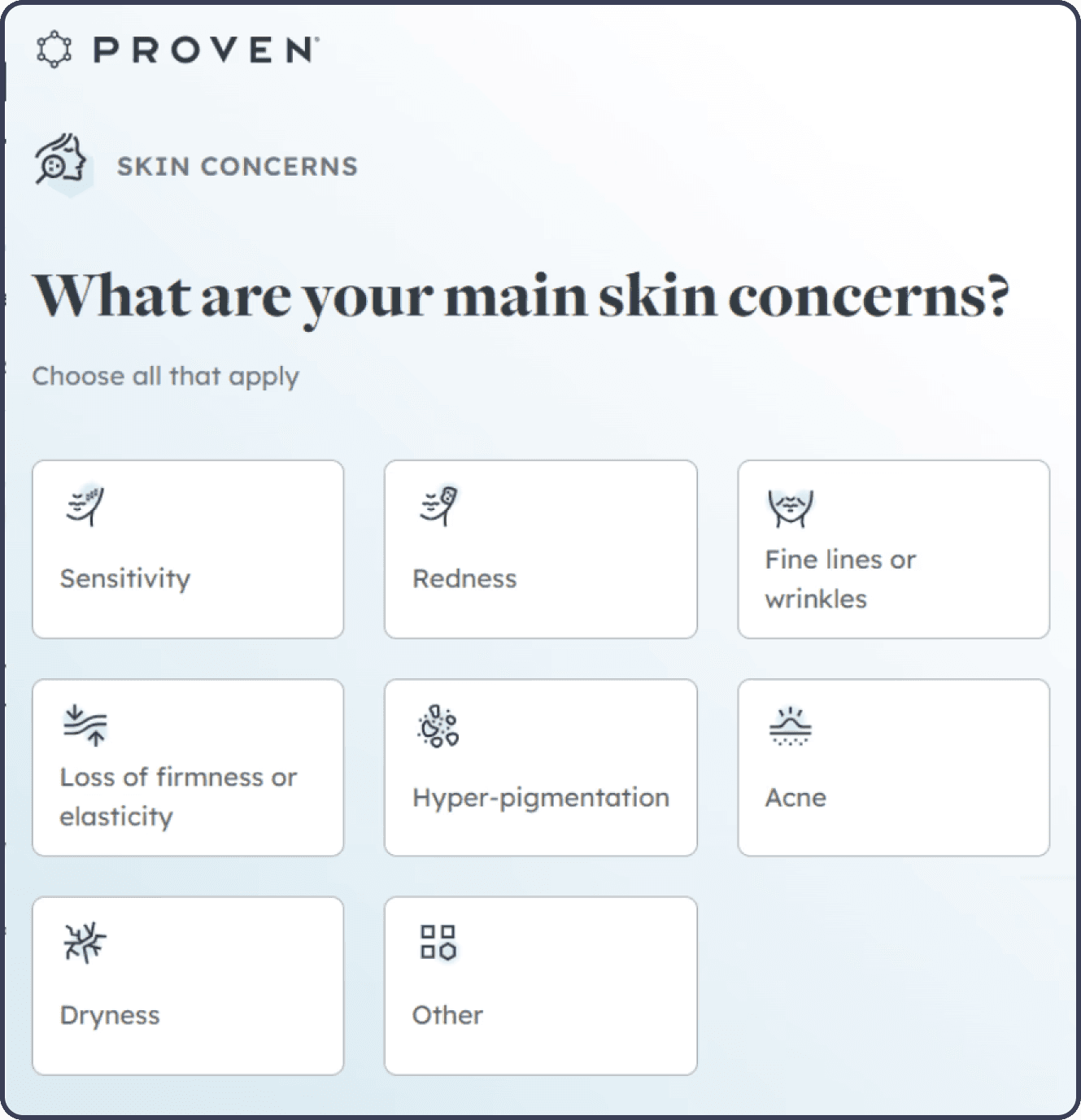

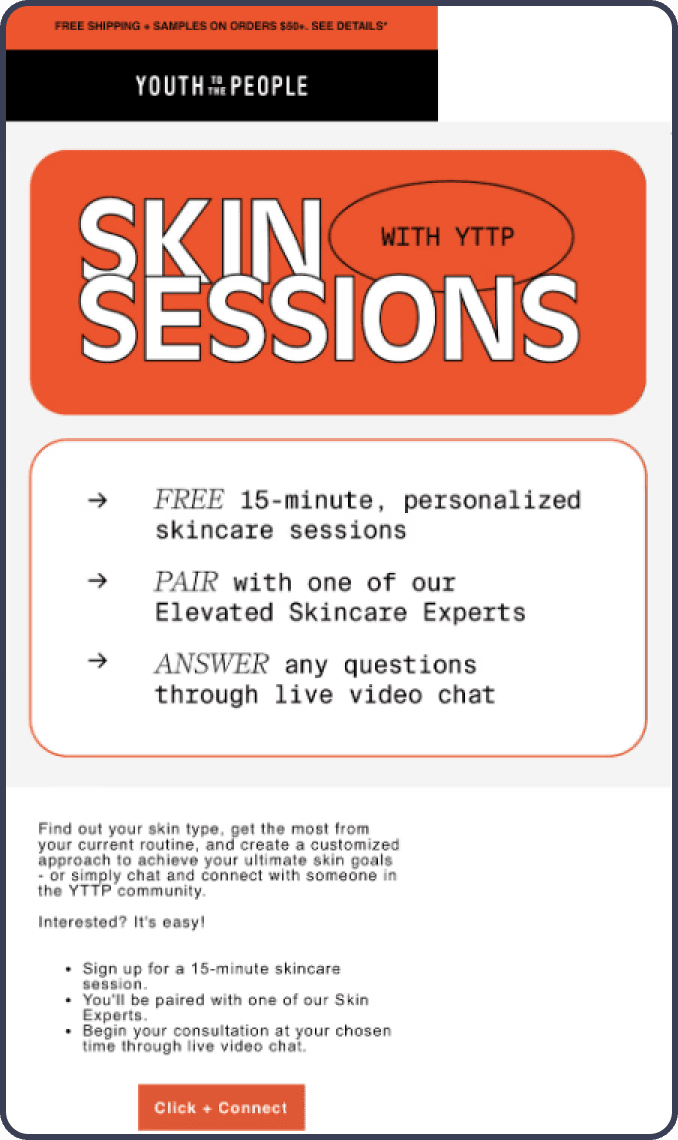

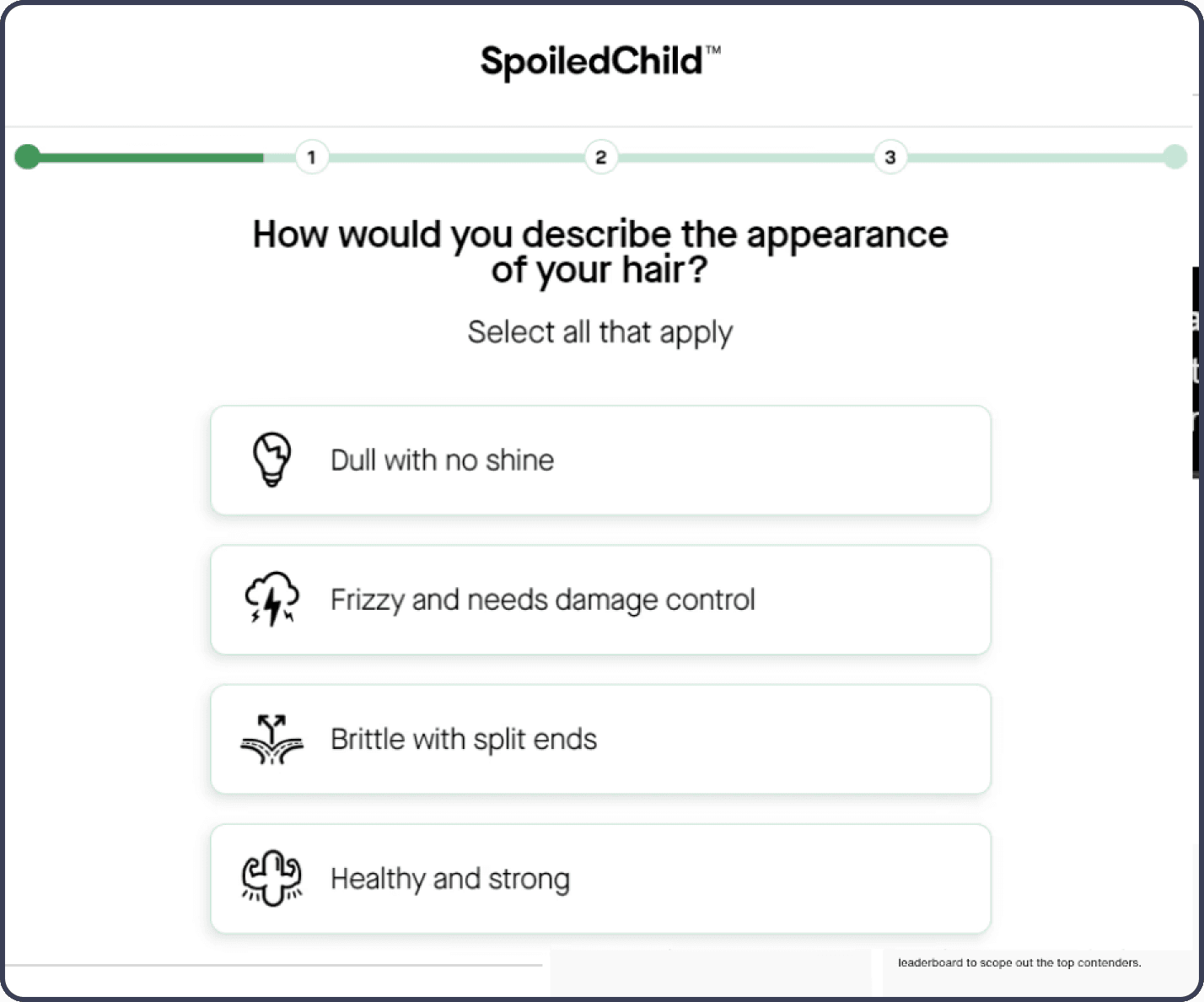

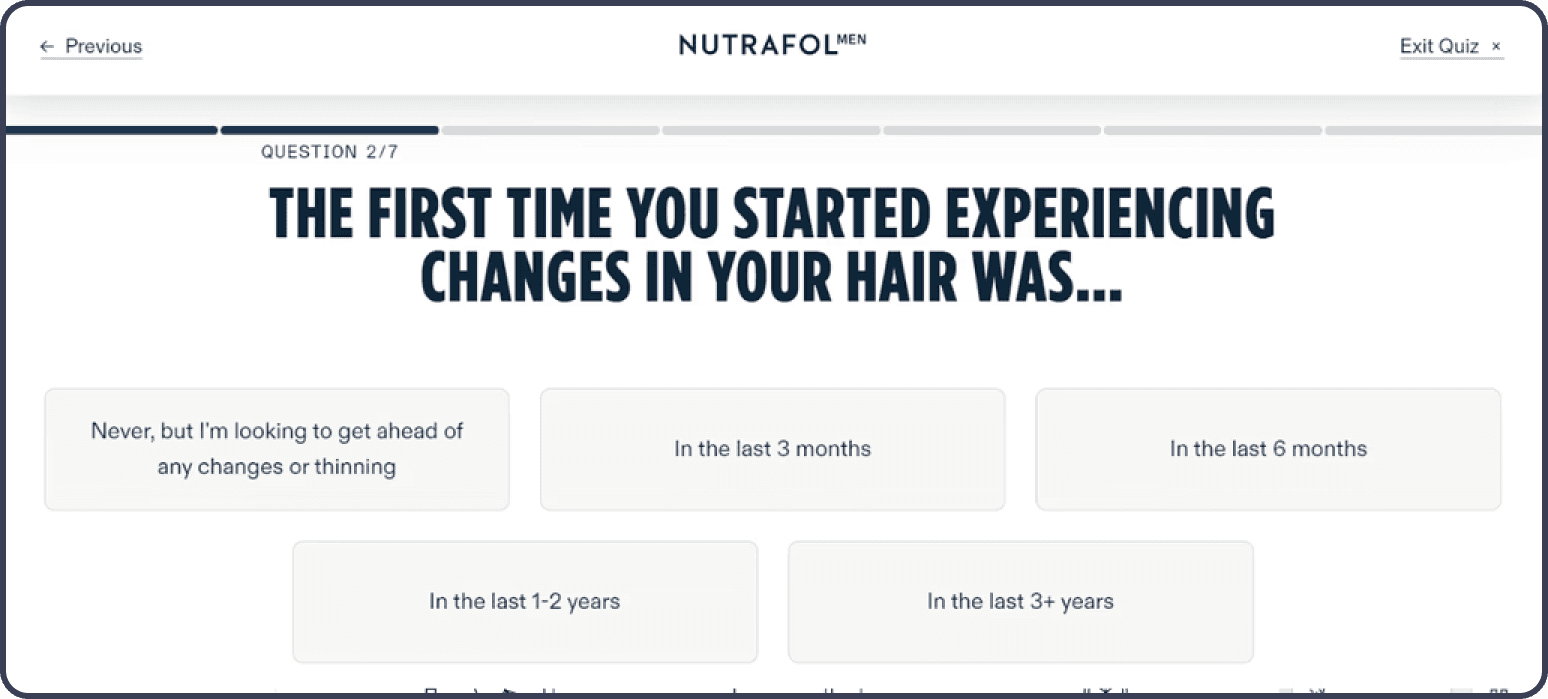

Overwhelmed by vast amounts of contradictory information online, consumers seek personalized regimens through skin/hair type quizzes offered by companies. They're increasingly aware of ingredients' health and environmental impacts, especially with the rise of clean, vegan, and cruelty-free brands. Understanding how ingredients affect one's health has become crucial. Rather than extensive self-research and experimentation, consumers can now pay for customized routines. This shift offers both personalization for individuals and a streamlined process to obtain unique beauty regimens, putting tailored solutions at their fingertips.

Methodology

Cultural Review:

We conducted an in-depth review of cultural trends, industry reports, and consumer behavior studies to understand the current landscape of beauty personalization.

Expert Conversations:

We interviewed industry experts, beauty tech entrepreneurs, and marketing strategists to gain insights into the future of personalized beauty.

Survey:

Our survey gathers responses from a national panel of 613 Gen Z and younger millennial consumers (ages 16-31) on personalized beauty. The survey aims to understand how much more this generation would pay for made-for-them makeup and skincare products. Respondents answer questions exploring their desire for customized product formulas, curated online shopping experiences, and diversity in brands. This data will help brands adapt to the growing consumer demand for personalized products. All respondents live in the United States.

Biases and Conflict of Interests:

The survey process excludes demographic information such as race, gender, and ethnicity, resulting in generalized data for the entire beauty and skincare consumer market. Additionally, the data collection focuses specifically on Gen Z consumers, meaning the trends in personalized beauty are only reflective of individuals under the age of 32 and cannot be accurately generalized to the entire population.

The Future of Beauty is Personal

The rise of customized skincare is at the forefront of the beauty. Consumers are increasingly seeking products formulated specifically for their skin type, concerns, and environmental factors. Brands are leveraging data analytics and AI to offer bespoke skincare solutions. Makeup personalization is also becoming a standard, with foundation shades perfectly matching individual skin tones and lip colors that complement personal style. Virtual try-ons and AI-powered color matching tools are enhancing the consumer experience. Hair care is seeing significant personalization as well, with products tailored to hair type, texture, and specific needs such as moisture, volume, or color protection. Personalized hair care regimens are being created using consumer data and advanced algorithms. Meanwhile, the fragrance market is embracing personalization with bespoke scents crafted to individual preferences, and customizable fragrance kits and AI-driven scent recommendations are becoming popular among younger consumers.

The global personalized beauty market was valued at $38.9 billion in 2020 and is projected to reach $143.1 billion by 2030, growing at a compound annual growth rate (CAGR) of 13.8% from 2021 to 2030 (Allied Market Research, 2021). The broader consumer health and wellness market, which includes personalized beauty, is a $1.5 trillion market growing at 5-10% annually (McKinsey, 2021). According to Grand View Research (2023), the global personalized beauty products market size was valued at USD 38.0 billion in 2022 and is expected to expand at a CAGR of 7.6% from 2023 to 2030. Mordor Intelligence (2023) projects the personalized beauty market to reach USD 96.64 billion by 2028, growing at a CAGR of 7.47% during the forecast period (2023-2028). Additionally, the beauty tech market is expected to reach $8.93 billion by 2026, representing growth of over 102% compared to 2022 when it was valued at $4.41 billion (Arbelle).

In 2019, L'Oréal invested in Functionalab Group, a company offering personalized skincare and supplements. By 2022, L'Oréal's total sales reached €38.26 billion, marking an 18.5% increase (L'Oréal Annual Report, 2022). Estée Lauder acquired DECIEM, the owner of The Ordinary, for $1 billion in 2021, achieving net sales of $17.74 billion in fiscal 2022, a 9% rise (Estée Lauder Annual Report, 2022). Clinique's "Clinical Reality" campaign, utilizing AR for personalized skincare recommendations, led to a 20% increase in conversions and a 50% boost in customer engagement (Haptic Media, 2023). Prose, a personalized hair care brand, uses a 25-question quiz for product recommendations, serving over 1 million customers and experiencing 300% year-over-year growth (Beauty Independent, 2021). Research by Bolt indicates that 75% of shoppers are willing to pay more for personalized beauty experiences, with 72% of Gen Z consumers ready to pay over 10% extra (Bolt, 2023).

In 2024, where uniqueness is celebrated and individual needs are paramount, beauty has taken a decidedly personal turn. Today, consumers are not just seeking beauty products; they are on a mission for solutions meticulously tailored to their specific skin needs and aesthetic desires.

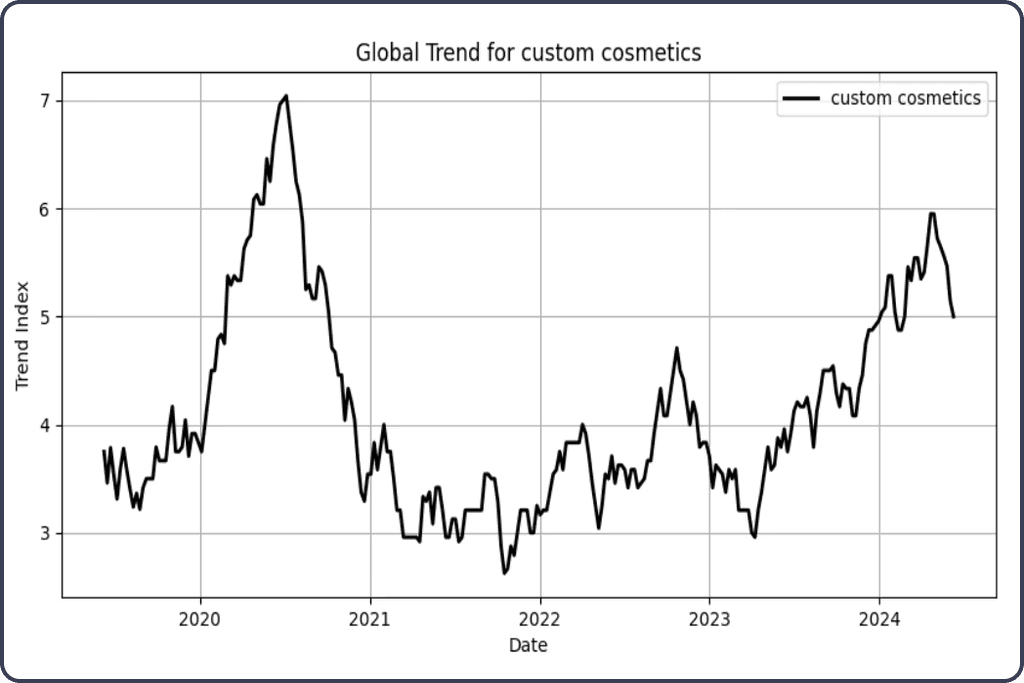

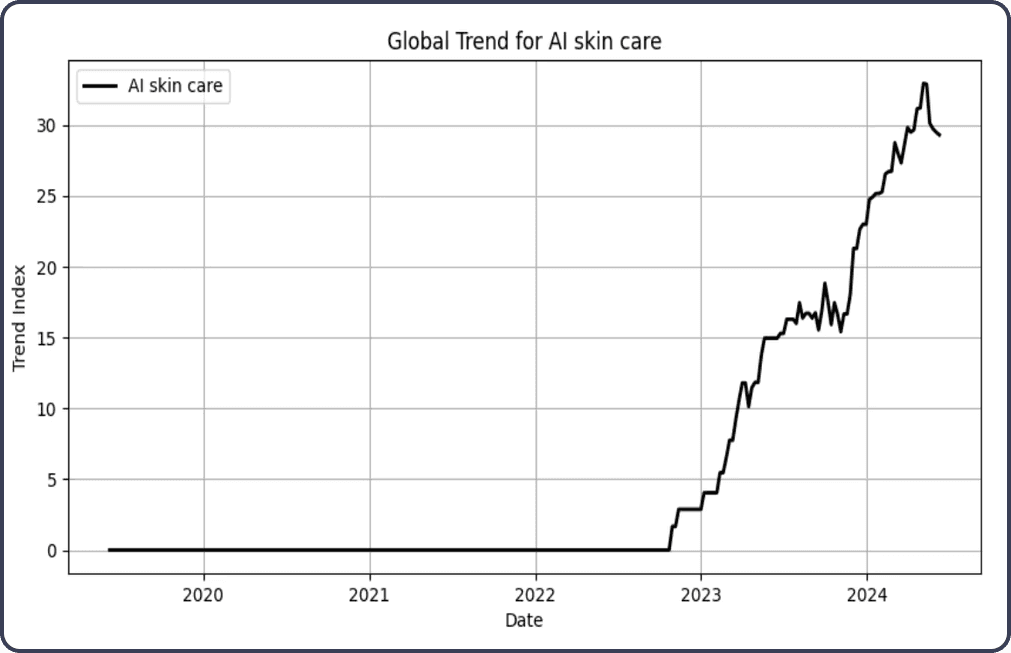

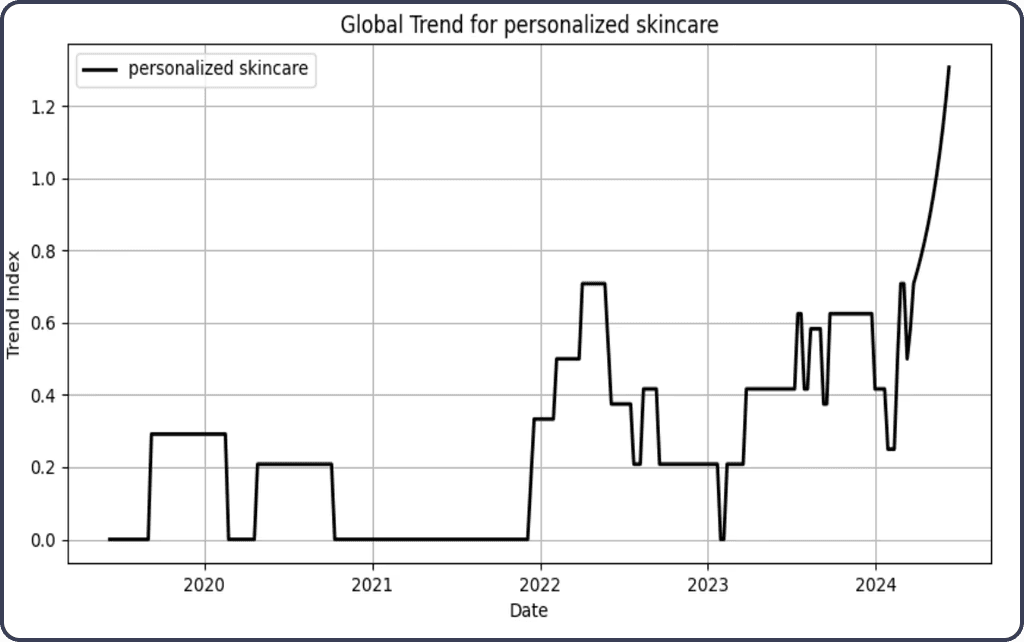

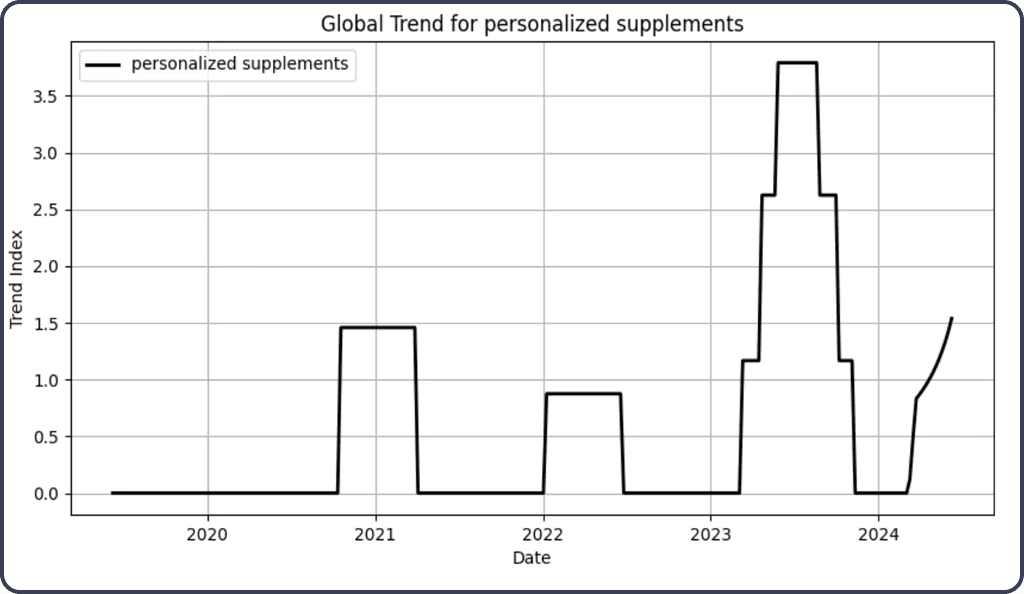

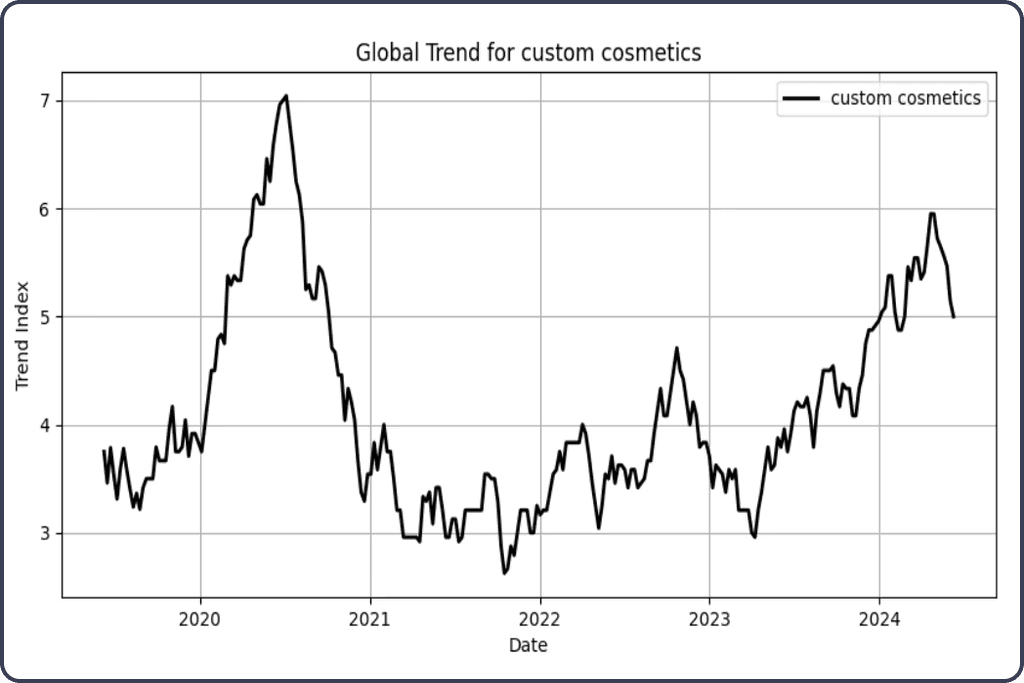

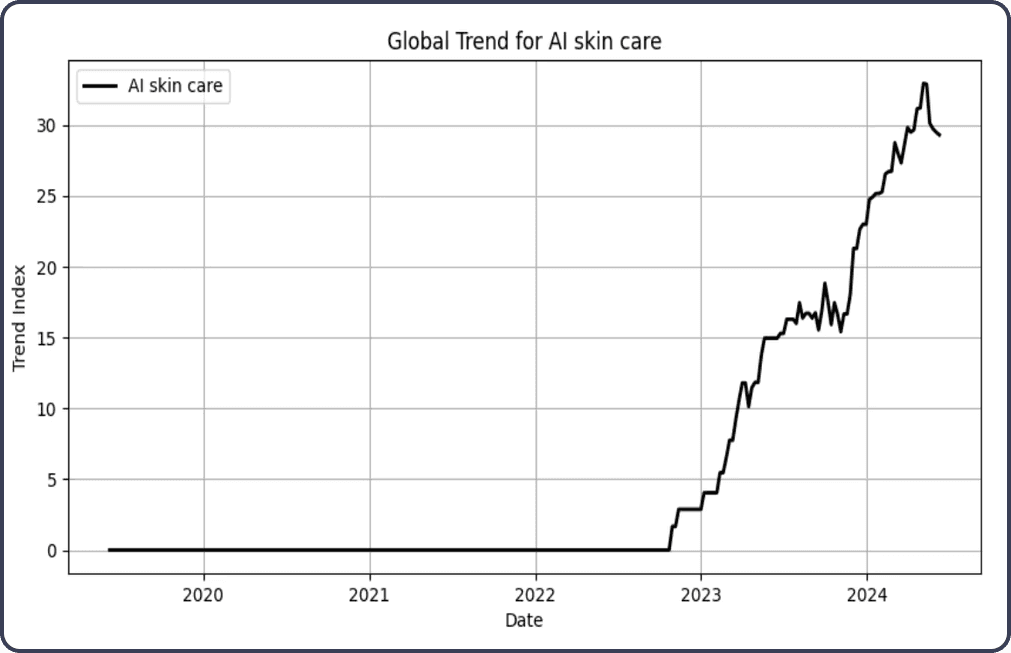

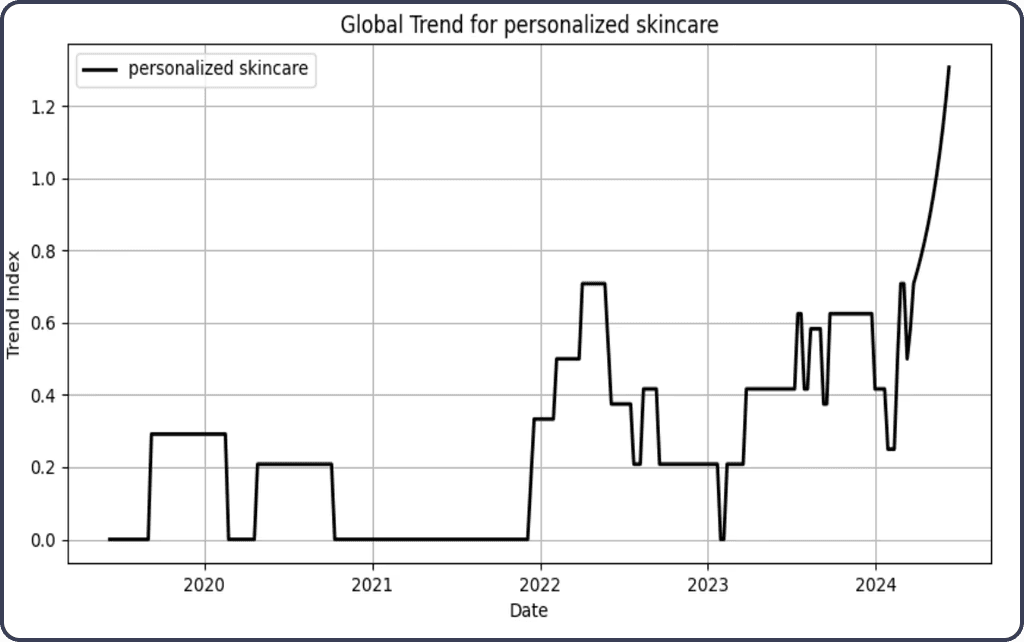

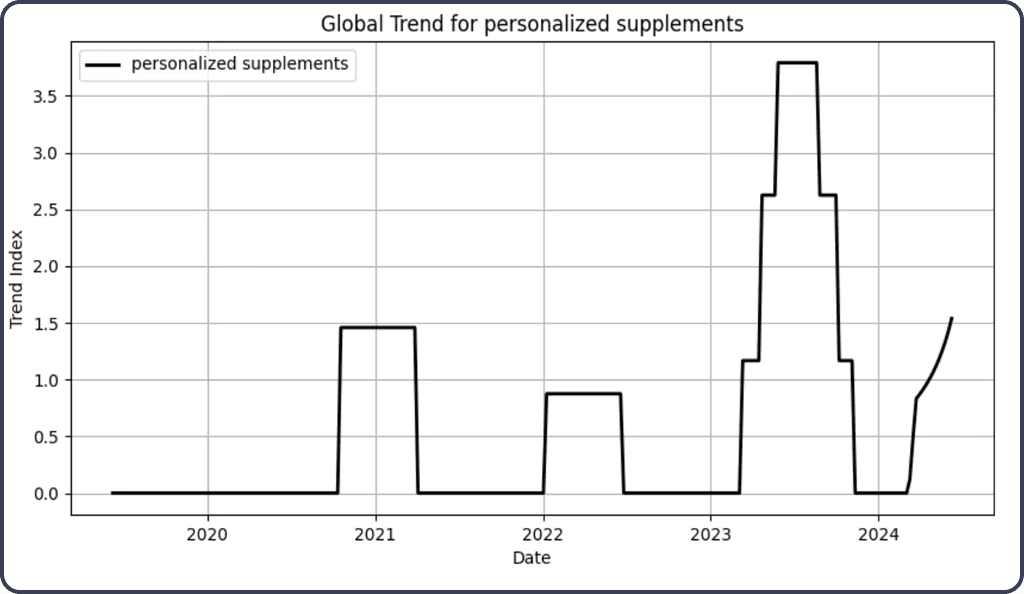

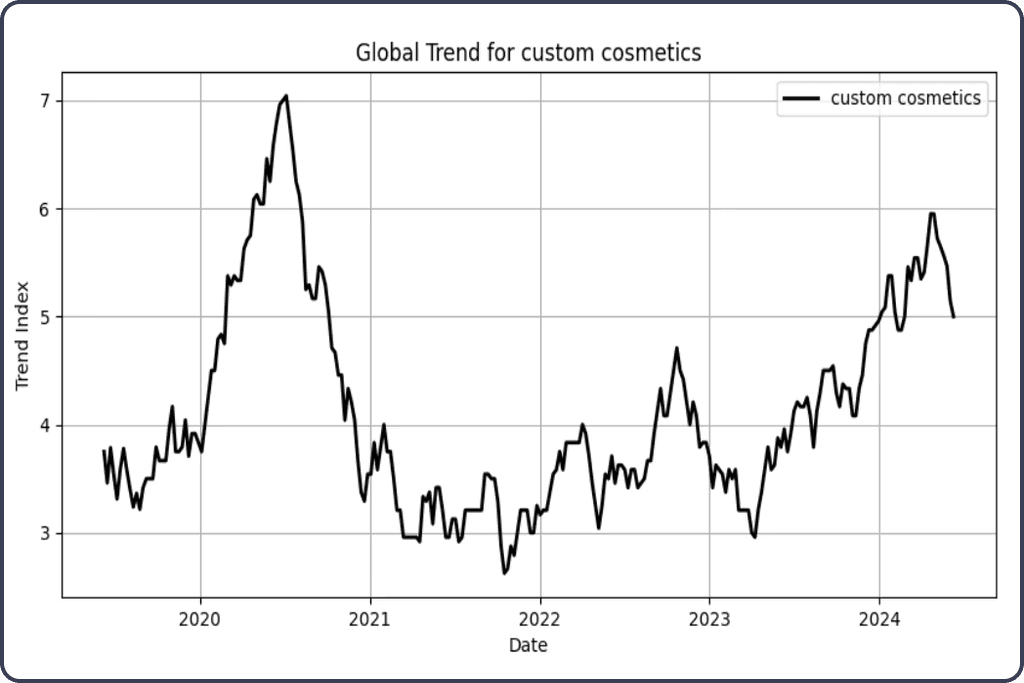

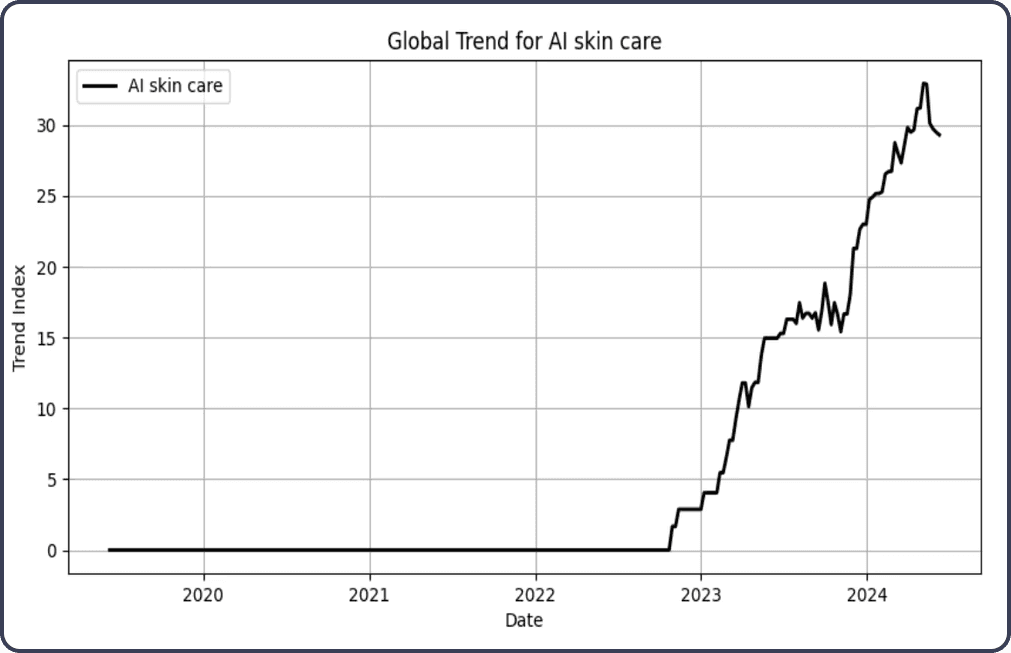

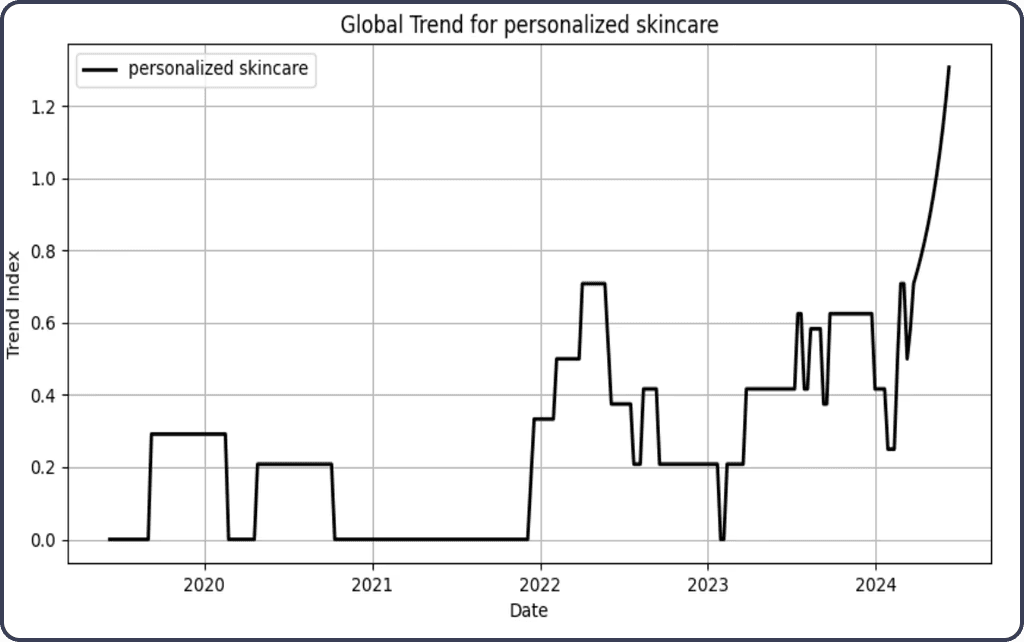

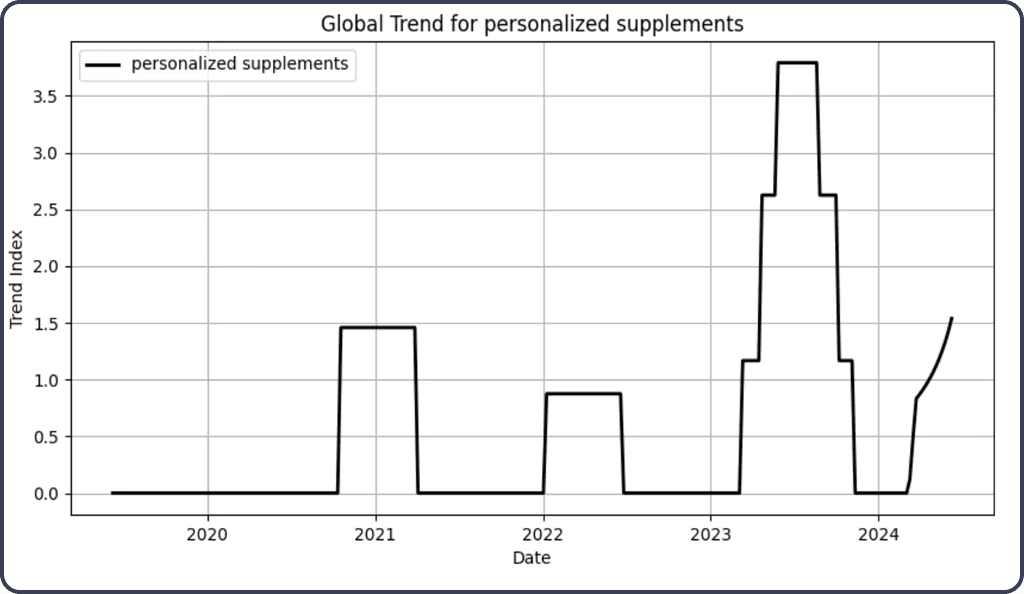

Global Google Trends Analysis: The Past 5 Years

Why Gen Z is Your Next Big Focus

Using Plural™, Wise Things' research and ad-testing proprietary platform, we surveyed a national panel of 613 youths aged 18-31. Learn more about Plural

“I wanted to buy one product that could solve my issues instead of buying multiple things that required research and effort to find.” - Anonymous

“I liked being able to see what skincare ingredients worked for my skin and what didn't!” - Anonymous

“For me, it’s important that brands offer diverse and inclusive products. It makes me feel seen when I purchase products that are meant to help me enhance and express my features.” - Anonymous

Throughout the survey, the dominant age group was consistently 20-22-year-olds, comprising at least 40% of the demographic. As more responses were collected, there was a noticeable shift in opinions on beauty and skincare spending habits, from occasional to weekly purchases. Additionally, the primary factor in purchasing decisions shifted significantly from price to brand reputation. The importance of personalization when purchasing beauty and skincare products decreased from an average rating of 10 to about 8 out of 10. Initially, most respondents had not purchased a product with a personalized shopping experience, but as more responses were collected, the majority indicated they had.

The data emphasizes the significant market for beauty and skincare products among Gen Z users, illustrating the importance of this research. This is shown through their frequent consumption of beauty products.

Key Insights:

Brand Reputation

Primary Factor: Brand reputation stands out as the top factor reported by survey respondents, underlining its crucial role in marketing and audience engagement. Examples: Brands like Milk and Glossier are trusted by consumers for their new product launches due to their strong brand reputations.

Social Media and Influencer Marketing

The role of social media and influencer marketing is highlighted, with PR packages sent to influencers and UGC creators demonstrating product usage and results.

Personalization

Data shows that survey respondents rate the importance of personalization at 8 out of 10, echoing the demand for customization and understanding of customers' unique needs and desires.

Affordability

Affordability is the second most important factor for respondents when purchasing beauty and skincare products.

100% of respondents consistently reported that they are willing to pay more for beauty and skincare products if they come with a personalized shopping experience. When asked how much more they would pay, responses shifted from $11-$20 more to $21-$30 more. Overall, respondents indicated they would pay up to 10-20% more for a custom and curated online shopping experience. When asked about the importance of diversity and inclusion in beauty and skincare brands, responses shifted from being extremely important to somewhat important. Initially, with fewer respondents, 100% were satisfied with the diversity and inclusion of the beauty and skincare brands they had already purchased from. However, as more responses were collected, only 82% of respondents expressed satisfaction with the diversity and inclusion of the brands they had purchased from.

The data emphasizes the significant market for beauty and skincare products among Gen Z users, illustrating the importance of this research. This is shown through their frequent consumption of beauty products. Brand reputation edges out as the top factor reported by survey respondents, highlighting its crucial role in marketing and audience engagement. Examples of brands with a strong reputation, like Milk and Glossier, demonstrate that consumers consistently trust their new product launches. The role of social media and influencer marketing is significant, with PR packages sent to influencers and UGC creators demonstrating product usage and results. Survey data shows respondents rating the importance of personalization at 8 out of 10, reflecting the demand for customization and understanding of customers' unique needs and desires. Affordability is the second most important factor in respondents' minds when purchasing beauty and skincare products. Amid increasing individualism seen in trends and aesthetics from social media such as cybersigilism punk, cottagecore, clean girl, and more, personalized beauty is becoming a top priority for Gen Z consumers when purchasing beauty and skincare products.

The biggest factor consumers look for when purchasing beauty and skincare products is brand reputation, followed by price and ingredients. The fact that brand reputation is the most considered factor supports the notion that Gen Z consumers are deeply invested in the diversity and inclusion of beauty and skincare brands, which also reflects the increase in individualism in today's society.

Brand Focus: Topicals

In our exploration of personalized skincare, we spoke with Sochima Mbadugha, VP of Strategy & Biz Ops at Topicals. Topicals is a beauty brand transforming the skincare experience with effective, science-backed products and a strong commitment to mental health advocacy. We asked Sochima, “What do you see as the biggest opportunities and challenges for skincare brands looking to offer truly personalized products at scale that resonate with different cultural values, traditions, and beauty ideals – both in terms of product development and marketing/customer experience?”

Sochima responded, “Skincare is rarely one-size-fits-all, so personalization allows brands to confidently claim efficacy based on an individual’s unique skin concerns. Brands like Curology have shown the effectiveness of these models, but even with personalization, customer satisfaction is not guaranteed. The inherent challenge of personalization is scaling it. It requires maintaining a larger number of SKUs in smaller quantities, making demand planning a nightmare. In regards to product development, any small tweak to a formula requires rounds of safety testing so in some ways it slows down your supply chain because you’re having to ensure efficacy on each variant of the formula before going to market. In short, it requires extensive investment without guarantee of ROI. However, if a brand has the capability to test and formulate efficiently then the opportunities are significant: market differentiation, increased customer loyalty, and valuable data insights, along with the ability to resonate with diverse cultural values and beauty ideals.”

AR/ML in Beauty

The global AI in beauty and cosmetics market is experiencing rapid growth, projected to soar from $2.68 billion in 2022 to $3.27 billion in 2023, and is expected to reach $6.8 billion by 2027. The beauty tech market is also set to expand significantly, aiming to hit $8.93 billion by 2026, doubling its size from 2022.

Beauty Boom: The global AI in beauty and cosmetics market is experiencing rapid growth, projected to soar from $2.68 billion in 2022 to $3.27 billion in 2023, with a continued upward trajectory expected to reach $6.8 billion by 2027. The beauty tech market is also set to expand significantly, aiming to hit $8.93 billion by 2026, doubling its size from 2022 (Report Linker, AI In Beauty And Cosmetics Global Market Report 2023).

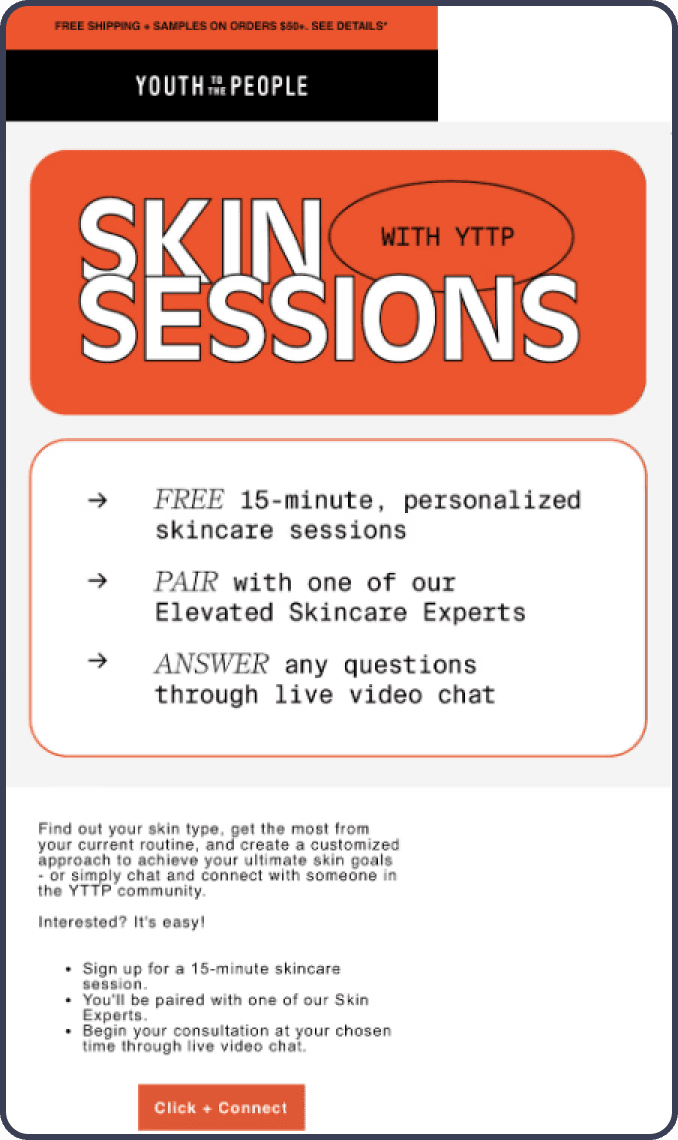

Virtual Glam: Virtual try-on tools are revolutionizing customer engagement and boosting sales. Shoppers using these tools are much more likely to make a purchase, and brands implementing them see a substantial reduction in product returns.

Tech-Savvy Beauty: The market for smart beauty devices, such as AR mirrors, is growing impressively, with an annual growth rate of nearly 19%. This market is anticipated to reach $144.2 billion by 2028, reflecting a significant technological advancement in beauty routines (Vantage Market Research, Beauty Devices Markets 2022).

Eco-Beauty: AI and AR are driving sustainability in the beauty industry by cutting down on the need for physical product samples and reducing waste. Virtual try-ons and personalized recommendations are key contributors to more sustainable beauty practices.

————————————————————————————————

The AI in beauty and cosmetics market size is expected to grow from USD 3.9 billion in 2023 to USD 15.9 billion by 2028, at a CAGR of 32.5% (Markets and Markets).

Virtual Try-ons are a tool that has significantly boosted customer engagement and sales. Smart beauty devices, such as AR mirrors, are growing at an annual rate of 18.8%, and is expected to rise to $144.2 billion by 2028 (Arbelle).

AI and AR are contributing to more sustainable practices in the beauty industry by reducing the need for physical product samples and minimizing waste through methods mentioned above.

Brand Focus:

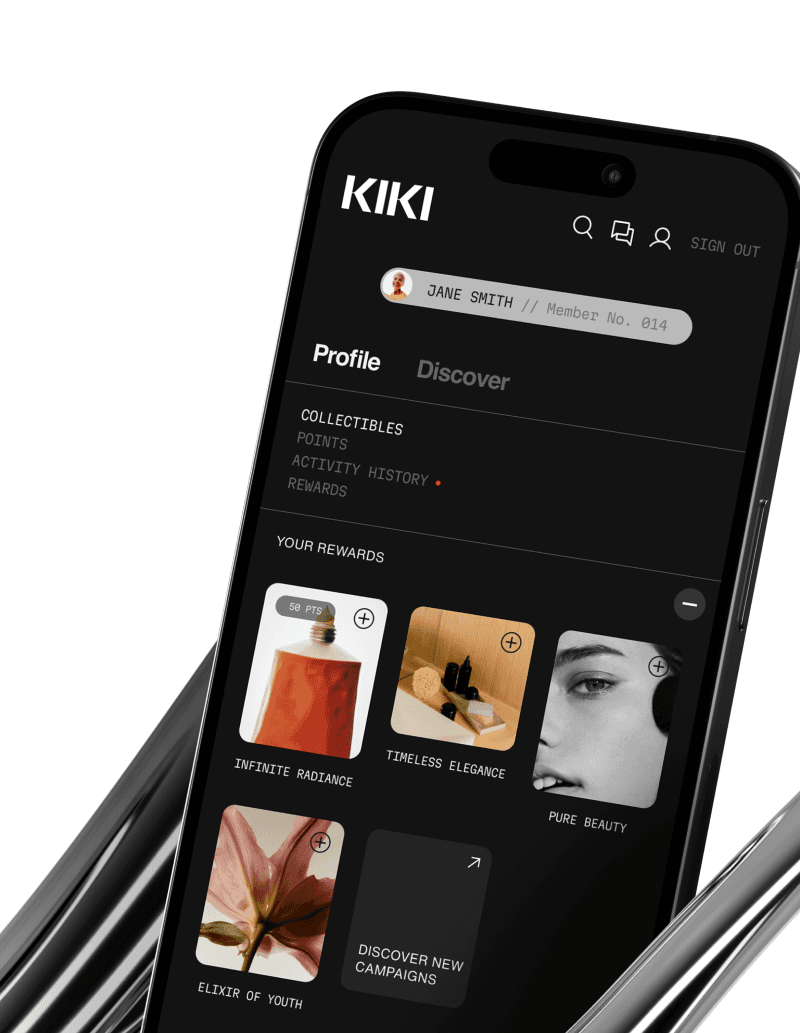

KIKI World

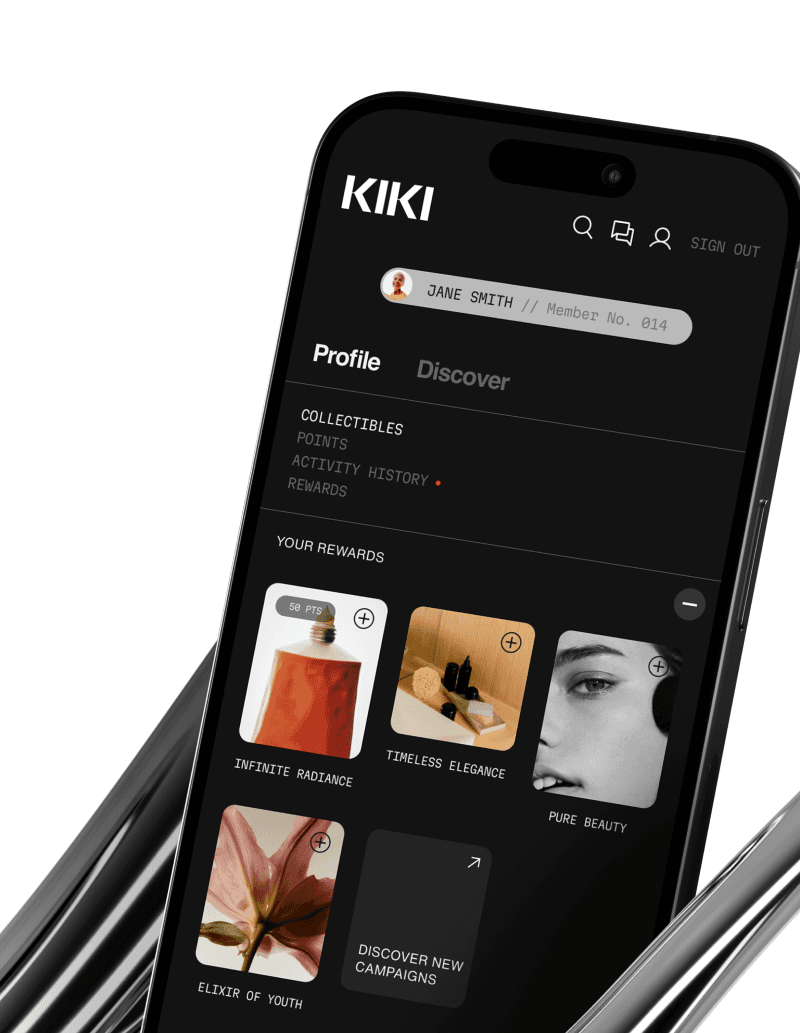

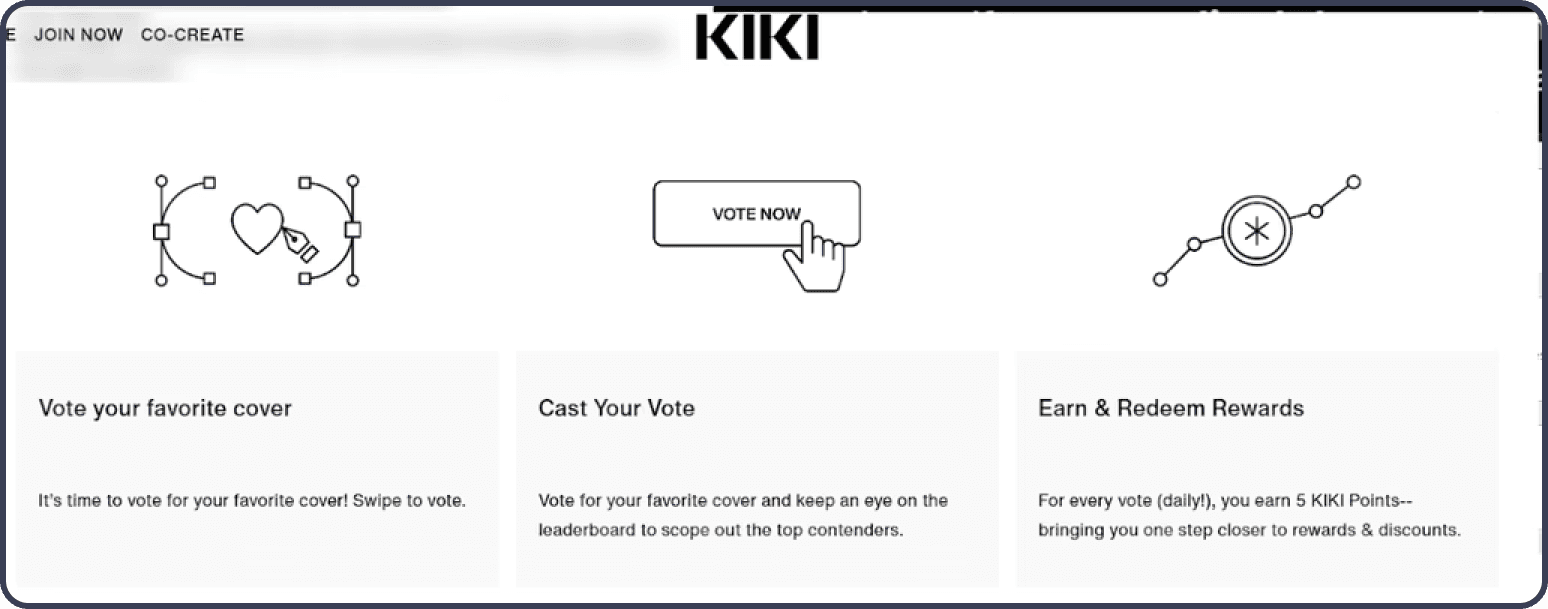

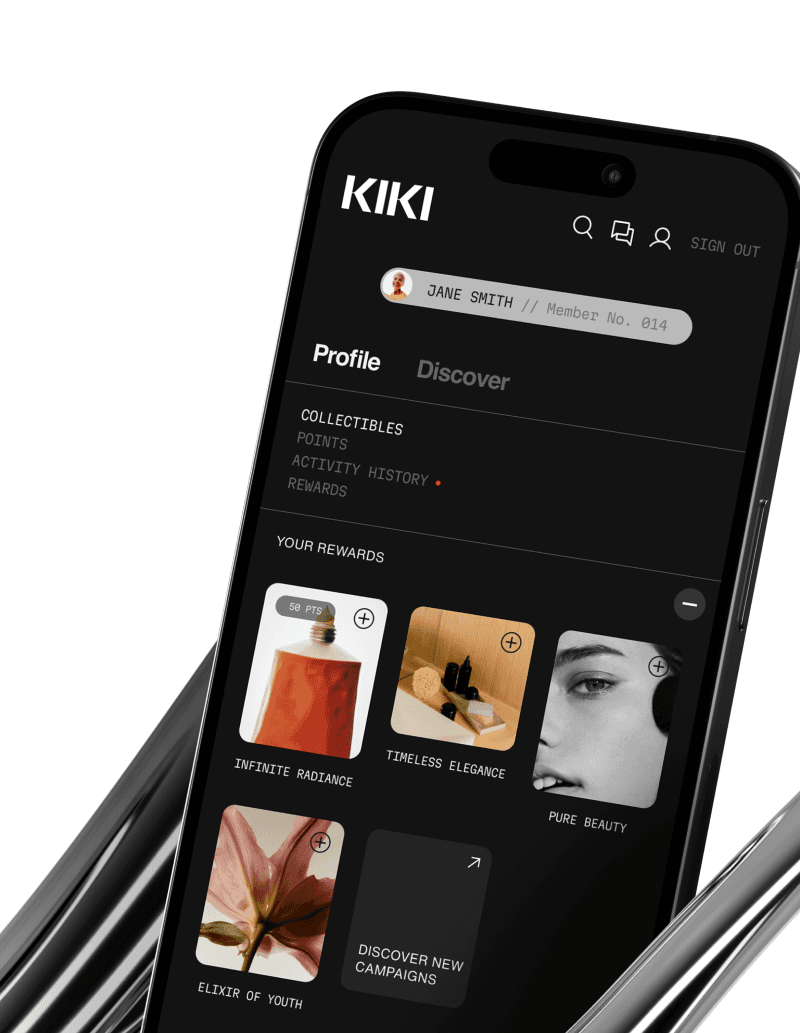

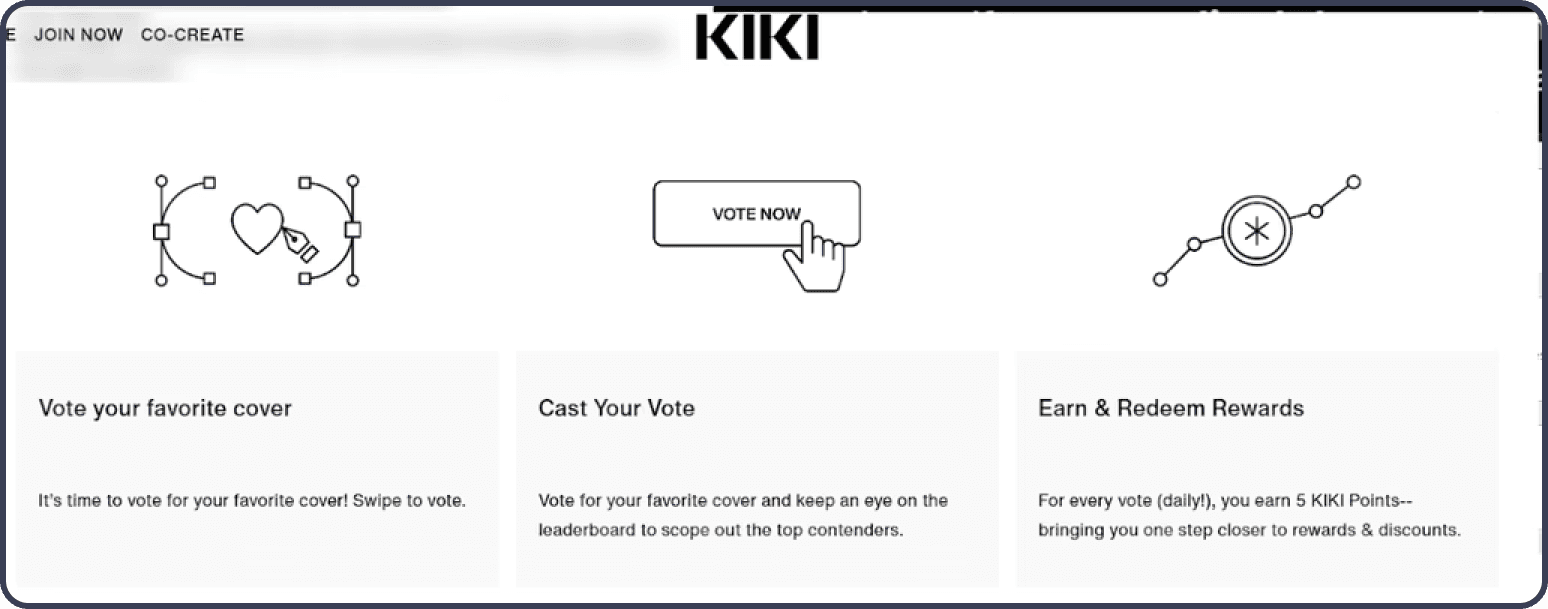

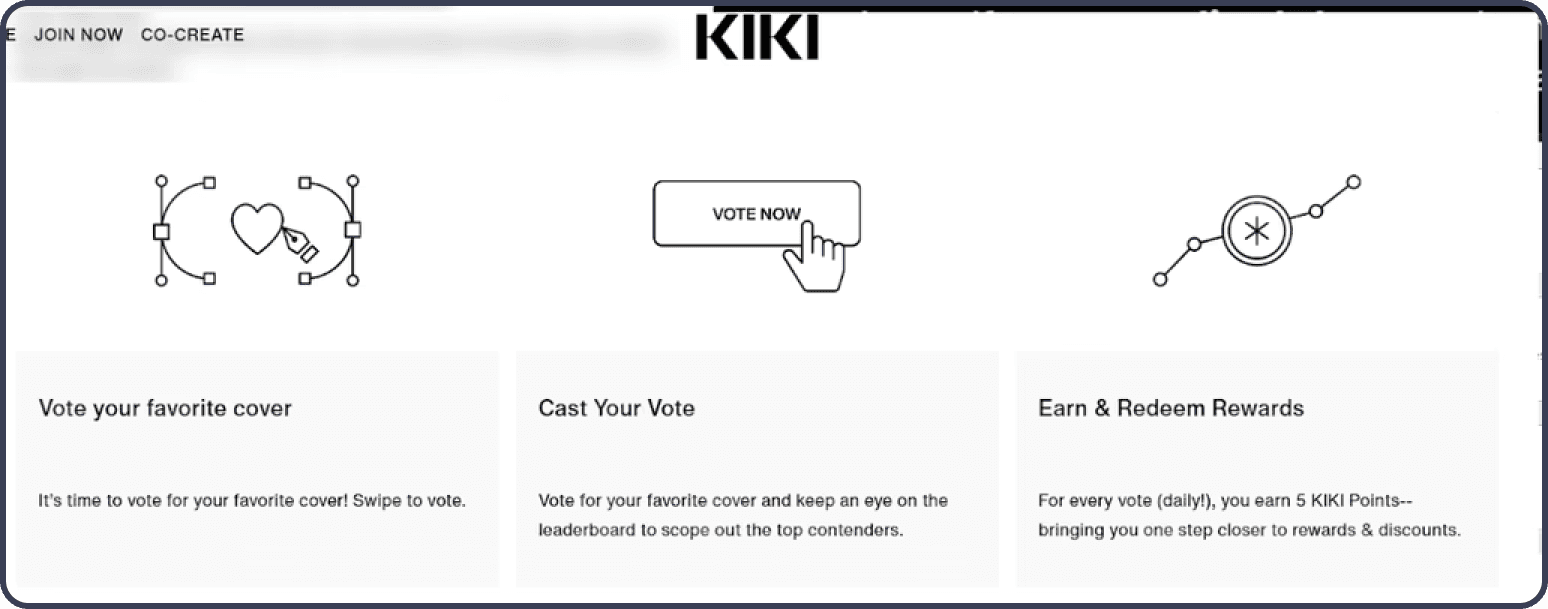

In our exploration of personalized skincare, we spoke with Jana Bobosikova, Co-Founder of KIKI World. KIKI World leverages AI and blockchain technologies to involve customers directly in the creation and voting process of beauty products, ensuring the final offerings precisely match consumer preferences.

In our conversation with Jana Bobosikova, she highlighted the challenges brands face with scalability and cost-effectiveness when offering personalized beauty products on a large scale. Jana explained, "Finding the right partners is crucial. It is no longer true that all products are dramatically cheaper to produce at massive scale. Thanks to improvements in supply chain technologies, additive manufacturing, and robotic small batch compounding, scalability and personalization are no longer opposite sides of the spectrum of growth, profitability, and success. It’s not what some of the large manufacturers with legacy, expensive infrastructure and extensive lead times will admit, but KIKI is proof that startup disruption is possible. We can produce what people want and reward them for input, not just for what they buy. It’s time to build something new, this time all together. Notably, this process also leads to an incredible pace of innovation, as demonstrated by the pipeline of our network, where we're sneak peeking the Future Face campaign."

Discussing the key factors driving personalization in beauty and their future evolution, Jana noted, "Front-end customization, such as online or in-store questionnaires and custom usage protocols or shade matching, is a ubiquitous business practice, an enormous source of loyalty, and a key component of building a healthy business. What’s newer is end-to-end customization, enabled by agile, additive manufacturing, leveraging predictive models for formulation, and truly customizing for a customer or a cohort. What’s unique and what we’re doing with KIKI, in addition to the above, is the co-ownership of the data involved by leveraging blockchains. This approach, building a network of data accessible by customers and creators, can transform the value chain and accelerate innovation across customer, creator, and product technologies and materials."

On the topic of promising technological advancements, Jana highlighted, "AI enhancing the way we formulate products or discover and compound new molecules is incredibly exciting and a huge opportunity for the personal care category at large. AR, especially in social apps, is informing the aesthetic of many trends, and VR is exciting but largely yet untapped. That said, these technologies are currently adopted largely through fairly centralized corporate networks en masse, and it’s unclear whether they will lead to customization or perhaps the opposite in the short term, while ultimately unlocking personalization in the long term."

Brand Focus:

Slate Brands

In our interview, Judah, CEO of Slate Brands, explained, “We leverage advanced technologies to tailor our beauty solutions to the preferences of today’s youth by gathering data from various sources, including competitor analysis, trend forecasting, in-house brand metrics, talent brand metrics, market research, and data scraping. This comprehensive approach helps us stay informed about trends and make well-informed decisions regarding our products and strategies.” He acknowledged the challenges of the highly competitive beauty industry, stating, “Despite the crowded market, our data-driven model allows us to transfer insights seamlessly across different business areas, helping us adapt quickly to technological advancements while ensuring our products remain effective and compatible.”

Regarding customer feedback, Judah emphasized its importance: “Customer feedback is crucial in shaping our personalized beauty products. We continuously collect and analyze feedback to gain a deeper understanding of consumer preferences, needs, and expectations.” He added, “This feedback is integral to our product development process, allowing us to make informed adjustments and innovations. Effective communication between our Data and Product teams ensures that feedback is integrated into our development process, enabling us to work on accelerated timelines and bring products to market that truly resonate with our customers.”

Influencer Marketing

Focusing on the youth demographic, brands have strategically tailored their marketing efforts, with 82% of campaigns targeting individuals aged 20-29 and 77% focusing on those aged 30-39 (Influencer Intelligence). This personalized approach highlights the industry's commitment to capturing the attention and loyalty of younger consumers, who are pivotal in shaping market trends. The financial investment in influencer marketing underscores its growing importance. In 2024, 34% of marketing budgets are projected to be allocated to influencer campaigns, with 16% planning to invest between 30% to 49% (Influencer Intelligence). This allocation signifies the trust marketers place in influencers' ability to drive brand engagement and consumer conversion. Content creation remains a critical aspect of influencer marketing. A significant 57% of marketers rely on influencers to generate content for their channels, and 33% have found success by granting influencers creative freedom (Influencer Intelligence). This approach not only fosters authenticity but also aligns with the preferences of younger audiences who value genuine, relatable content. Instagram continues to dominate as the leading platform for influencer marketing, with 54% of marketers reporting the most success in 2023. However, TikTok is rapidly emerging as a formidable contender, with 28% of marketers achieving success and 44% planning increased investment in 2024 (Influencer Intelligence). This shift highlights the evolving landscape of social media platforms and their impact on influencer marketing strategies.

Looking to the future, purpose-driven campaigns are expected to play a crucial role, with 76% of marketers emphasizing their importance for customer connection. Furthermore, 85% predict a rise in video and audio content partnerships, reflecting the shifting consumer preferences towards more engaging and dynamic content formats (Influencer Intelligence). Brands have adeptly harnessed these trends by collaborating with influencers on sponsored content and exclusive product lines, fostering a sense of scarcity and novelty. This strategy accelerates consumption cycles, as Gen Z rapidly adopts and discards personalized beauty trends (Mardon et al., 2018). Influencers advocate for the personalization of beauty regimens through trial and error, driving excess purchasing behaviors and brand loyalty (Barlido et al., 2021). Social media influencers are now the primary source of information about beauty products for younger consumers. According to Forbes, younger consumers prefer to seek personal responses from influencers online. The influencer marketing industry is projected to reach a valuation of $22.2 billion by 2025, underscoring its effectiveness and the increasing investment from marketers (Rockpaperreality). TikTok and Instagram remain the dominant platforms for influencer partnerships, essential for reaching Gen Z and Gen Alpha audiences. Authentic content and long-term collaborations resonate deeply with these demographics, who prioritize genuine recommendations and reviews. Influencers' use of affiliate links and storefronts on platforms like Amazon and TikTok further streamline the purchasing process, enhancing consumer convenience.

Successful campaigns, such as Emma Chamberlain's promotion of Curology and Clinique's micro-influencer initiatives, demonstrate the impact of influencer marketing on brand awareness and consumer purchasing intentions (Tumblr; Territory Influence). Milk Makeup's engagement with user-generated content creators showcases the power of community connection through influencer collaborations.

The rise of influencer entrepreneurship in the beauty industry has been prominent across social media, with brands like Summer Fridays, Sacheu Beauty, Rhode, One/Size, Patrick Ta, and Ouai all created by influencers. The success of these influencer beauty brands highlights the power of personal branding in marketing. Each influencer brings a unique personality and brand, effectively communicating with their audience and helping to build a strong community around their products.

Studies show Gen Z is heavily influenced by social media in their purchasing decisions, with 44% citing influencer recommendations as their top source for beauty inspiration (MacDonald, 2021). The pandemic accelerated the adoption of digital tools for personalization, driving significant market growth. Social media encourages customers to share their personalized beauty experiences, generating authentic user-generated content that resonates with potential customers. Platforms like Instagram and Snapchat offer AR filters that enable users to virtually try on makeup or hairstyles.

Social media serves as a real-time focus group for beauty brands, helping them identify emerging trends and consumer preferences.

The rise of “skinimalism”/ “clean girl” as a beauty trend was largely driven by social media discussions.

Allows personalized beauty brands to build communities around their products.

Glossier, known for its personalized approach, has built a community of over 3 million followers on Instagram.

Social commerce features on platforms like Instagram and Facebook allow personalized beauty brands to sell directly to consumers.

Social media serves as a platform for real-time customer service and feedback collection.

According to Sprout Social, 77% of consumers are more likely to buy from a brand they follow on social media

Personalization in Motion

Drivers of Personalization in Beauty

Technology and Innovation

Advancements in technology, such as AI, machine learning, and data analytics, are enabling brands to offer personalized beauty solutions at scale. These technologies help in understanding consumer preferences and creating products that meet their specific needs.

Consumer Demand

Today's consumers, especially Gen Z and Millennials, prioritize individuality and self-expression. They expect products that resonate with their personal identity and lifestyle. This shift in consumer behavior is driving brands to focus on personalization.

Health and Wellness

There is a growing awareness about the importance of health and wellness in beauty. Personalized products that cater to individual health needs and promote overall well-being are gaining traction. Consumers are looking for clean, safe, and effective products.

Sustainability and Ethics

Personalization also aligns with the values of sustainability and ethical consumption. Customized products reduce waste and promote responsible use of resources. Brands that emphasize sustainability in their personalized offerings are more likely to attract young, conscious consumers.

What's Next?

Leveraging Social Media and Influencer Marketing

Brands can start to utilize social media platforms such as TikTok and Instagram to leverage their reach. By employing marketing strategies like influencer marketing, they can target the Gen Z audience with authentic reviews of personalized beauty products and recommendations. Influencers provide a relatable and trustworthy voice that resonates with this demographic, making personalized products more appealing.

Prioritizing Diversity, Authenticity, and Affordability

Existing studies and our research highlight the importance of diversity, authenticity, and affordability for brands looking to resonate with progressive Gen Z consumers. This generation values individualism and uniqueness, and brands that prioritize these elements in their marketing and product development are more likely to succeed. Transparent communication and inclusive product lines foster trust and loyalty among young consumers.

The Importance of Personalization and Community

Personalization and community have become increasingly important to consumers. Brands like Saie Beauty exemplify this by hosting events for influencers and community members, where they provide personalized product selections and master classes on product usage. These curated events not only highlight brand inclusivity but also allow consumers to connect with the brand in a meaningful way. This educational aspect strengthens the bond between the brand and its community, showcasing the importance of personalized experiences.

Collaborative Efforts for Enhanced Consumer Engagement

Emphasis on community is crucial, and brands should explore collaborations with other brands to deliver thoughtful experiences and products that resonate with shared audiences and values. For example, the collaboration between Inn Beauty and Poppi lip oil demonstrates how brands can merge their communities and offer unique, personalized products that appeal to both audiences.

Market Trends: Moving Forward

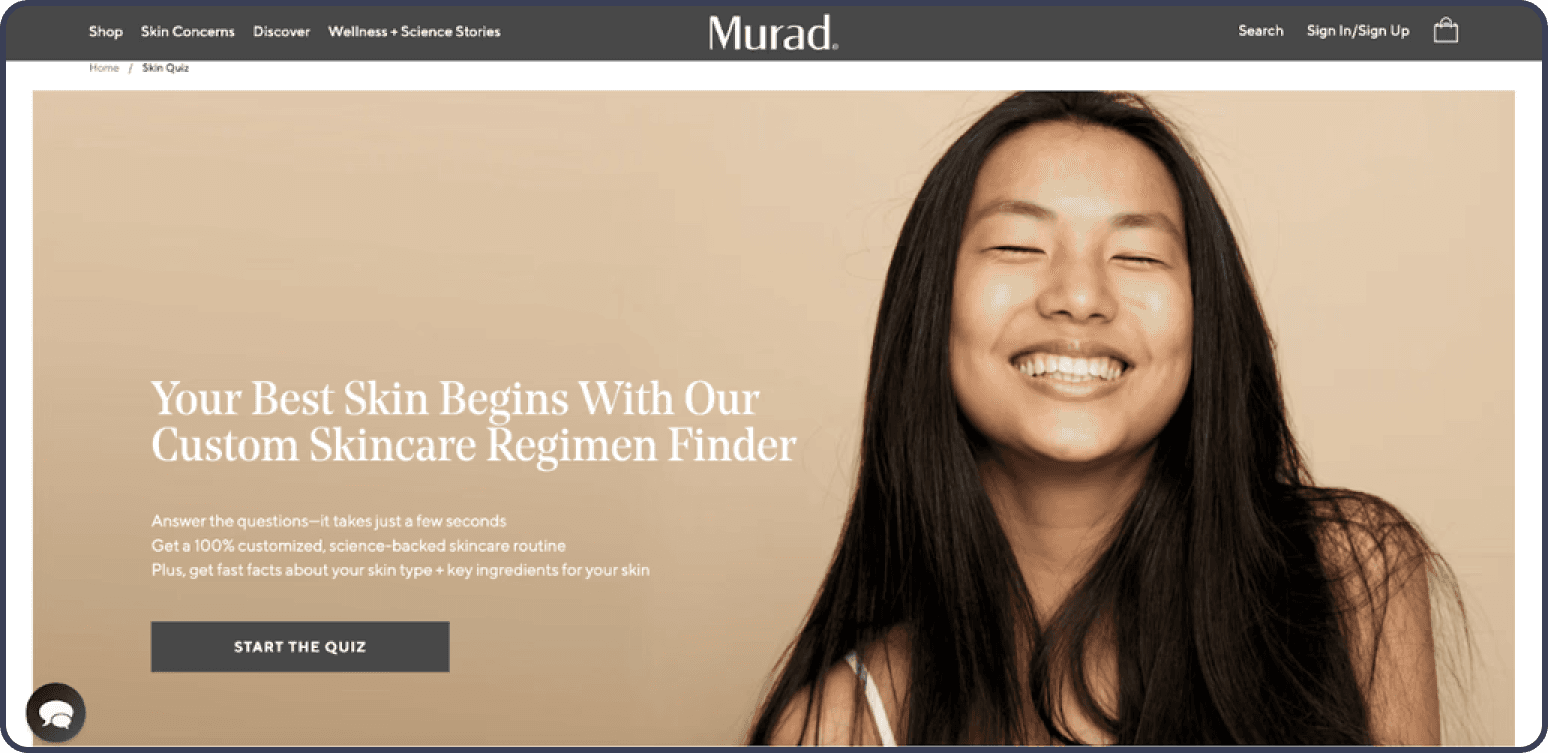

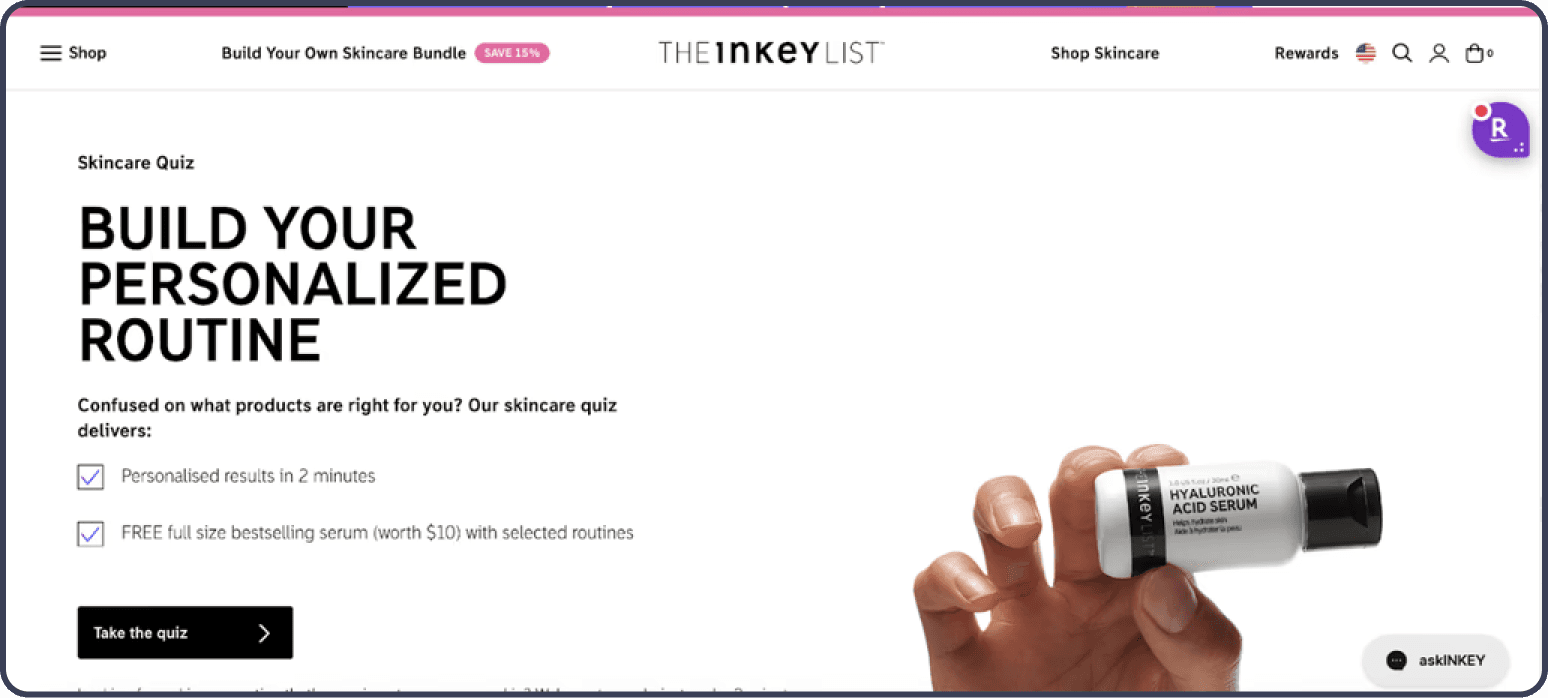

The market for personalized beauty products is progressing. Brands like Ulta are enhancing their efforts to create personalized skincare and beauty products through strategies like personalized online quizzes. These quizzes assess skincare needs and match consumers to suitable products, allowing brands to participate in the personalized beauty industry even without custom products. Brands like Bulldog Skincare are advancing the market with AI analysis, providing refined methods for analyzing consumer skin types and needs. This technological approach allows brands to offer better-tailored products. Conversely, brands like Curology are falling behind by not offering personalized shopping experiences, as consumers must rely on their knowledge to select products, reducing the personalized aspect of their service.

Consumer Perspective

Consumers want to interact with brands to connect with the communities the brands cultivate. They seek connections with people who share their values and interests and enjoy showcasing their own through the products they use. Personalized beauty allows consumers to form individualized routines that express their authentic selves on social media and in everyday life.

The Future of Personalized Beauty

The beauty and skincare market is trending towards increased personalization. This trend is driven by consumer demand for tailored experiences, technological advancements that enable scalable customization, and the competitive advantage personalization offers brands. This aligns with broader personalization trends across various industries, indicating a continued focus on individualized products and services in the future. To capitalize on this wave of personalized beauty, brands need to listen to their communities and create curated experiences for their consumers. Improving marketing strategies through influencer marketing and utilizing AI and AR analysis tools can attract Gen Z consumers to personalized beauty and skincare brands. The future of the market looks bright for those who embrace personalization and foster strong consumer connections.

The rise of customized skincare is at the forefront of the beauty. Consumers are increasingly seeking products formulated specifically for their skin type, concerns, and environmental factors. Brands are leveraging data analytics and AI to offer bespoke skincare solutions. Makeup personalization is also becoming a standard, with foundation shades perfectly matching individual skin tones and lip colors that complement personal style. Virtual try-ons and AI-powered color matching tools are enhancing the consumer experience. Hair care is seeing significant personalization as well, with products tailored to hair type, texture, and specific needs such as moisture, volume, or color protection. Personalized hair care regimens are being created using consumer data and advanced algorithms. Meanwhile, the fragrance market is embracing personalization with bespoke scents crafted to individual preferences, and customizable fragrance kits and AI-driven scent recommendations are becoming popular among younger consumers.

The global personalized beauty market was valued at $38.9 billion in 2020 and is projected to reach $143.1 billion by 2030, growing at a compound annual growth rate (CAGR) of 13.8% from 2021 to 2030 (Allied Market Research, 2021). The broader consumer health and wellness market, which includes personalized beauty, is a $1.5 trillion market growing at 5-10% annually (McKinsey, 2021). According to Grand View Research (2023), the global personalized beauty products market size was valued at USD 38.0 billion in 2022 and is expected to expand at a CAGR of 7.6% from 2023 to 2030. Mordor Intelligence (2023) projects the personalized beauty market to reach USD 96.64 billion by 2028, growing at a CAGR of 7.47% during the forecast period (2023-2028). Additionally, the beauty tech market is expected to reach $8.93 billion by 2026, representing growth of over 102% compared to 2022 when it was valued at $4.41 billion (Arbelle).

For younger consumers, customized beauty formulas and packaging are incredibly appealing. The vast array of products available online can make finding the right one frustrating and time-consuming. This report, featuring zero-party consumer data and expert opinions, explores how the desire for personalized beauty is driving significant interest in custom beauty products among younger consumers.

For younger consumers, customized beauty formulas and packaging are incredibly appealing. The vast array of products available online can make finding the right one frustrating and time-consuming. This report, featuring zero-party consumer data and expert opinions, explores how the desire for personalized beauty is driving significant interest in custom beauty products among younger consumers.

Brought to you by

For younger consumers, customized beauty formulas and packaging are incredibly appealing. The vast array of products available online can make finding the right one frustrating and time-consuming. This report, featuring zero-party consumer data from 613 youths and expert opinions, explores how the desire for personalized beauty is driving significant interest in custom beauty products among younger consumers.

Brought to you by

Authors: Onanma Okeke, Saloni Bonde, Wendy Qian, Noemi Morales, and Mary Ngo

Brought to you by

Corvane is an AI-powered consumer and market intelligence platform that empowers you to create brands, ads, products, and shopping experiences that people love. Our commitment extends to providing our research and ad-testing proprietary platform built from the ground up.

BeautyMatter is an essential daily resource for industry insiders who demand the most current beauty intelligence. An essential resource for insiders filling the void, connecting the dots, and providing a perspective that is informed, analytical, and has a compelling point of view. We help leaders stay connected and informed in a constantly changing world..

Introduction

Consumers now have the opportunity to participate in creating products uniquely tailored to meet their individual needs and preferences. This gravitation towards more customer-based solutions allows consumers to be a part of the process, increasing their attachment to the products they help create. The beauty industry is undergoing a shift towards personalization, driven by the evolving preferences of the younger generation. As technology advances and consumer expectations change, the future of beauty is becoming increasingly personal. This report explores the trends, drivers, and implications of this transformation using zero-party data from 613 individuals in the USA aged 18-31. Is the future of beauty personal?

Market Shifts: The beauty industry is adapting to meet the demand for personalized products, influencer marketing and product development strategies. In a world where most things are mass-produced, individualism is becoming increasingly important.

Sustainability: Customized products can reduce waste, appeals to environmental concerns amidst climate crisis.

Consumer Involvement: When customers are involved in the process, they develop a stronger attachment to the product, which becomes a reflection of their own identity. This is especially significant in a market characterized by fast product cycles and the impersonal nature of mass production. Personalized beauty is not just a trend; it is a fundamental shift in how products are created, marketed, and consumed. Young consumers are seeking products tailored to their unique needs, preferences, and identities. This demand for customization is reshaping the industry, pushing brands to innovate and adopt new technologies to stay relevant.

Embracing Diversity: The beauty industry is evolving to address diverse, previously unmet consumer needs. Product diversity and inclusivity are now crucial, encompassing various skin colors, hair types, and specific conditions. This broader representation validates consumers across different demographics, fostering a sense of acknowledgment and belonging. As a result, inclusivity has become both an ethical imperative and a key factor in brand success.

The beauty industry is experiencing a significant transformation driven by the demands of younger consumers, particularly Gen Z. These consumers are seeking highly personalized and unique experiences across skincare, makeup, and haircare, actively participating in the co-creation of products tailored to their specific needs and preferences. This shift towards customization and active consumer involvement is being facilitated by technological advancements, enabling brands to offer increasingly personalized solutions. As a result, the future of beauty is becoming more individualized, with tech-driven personalization at its core. This is reshaping various aspects of the industry, from product development and marketing strategies to retail experiences and brand loyalty. Companies are likely to adopt more flexible production processes, interactive marketing approaches, and data-driven personalization techniques to meet these evolving consumer expectations. The movement towards personalization not only presents challenges for beauty brands but also offers significant opportunities for those able to successfully adapt to this new landscape, potentially gaining a competitive edge in the market.

Overwhelmed by vast amounts of contradictory information online, consumers seek personalized regimens through skin/hair type quizzes offered by companies. They're increasingly aware of ingredients' health and environmental impacts, especially with the rise of clean, vegan, and cruelty-free brands. Understanding how ingredients affect one's health has become crucial. Rather than extensive self-research and experimentation, consumers can now pay for customized routines. This shift offers both personalization for individuals and a streamlined process to obtain unique beauty regimens, putting tailored solutions at their fingertips.

Methodology

Cultural Review:

We conducted an in-depth review of cultural trends, industry reports, and consumer behavior studies to understand the current landscape of beauty personalization.

Expert Conversations:

We interviewed industry experts, beauty tech entrepreneurs, and marketing strategists to gain insights into the future of personalized beauty.

Survey:

Our survey gathers responses from a national panel of 613 Gen Z and younger millennial consumers (ages 16-31) on personalized beauty. The survey aims to understand how much more this generation would pay for made-for-them makeup and skincare products. Respondents answer questions exploring their desire for customized product formulas, curated online shopping experiences, and diversity in brands. This data will help brands adapt to the growing consumer demand for personalized products. All respondents live in the United States.

Biases and Conflict of Interests:

The survey process excludes demographic information such as race, gender, and ethnicity, resulting in generalized data for the entire beauty and skincare consumer market. Additionally, the data collection focuses specifically on Gen Z consumers, meaning the trends in personalized beauty are only reflective of individuals under the age of 32 and cannot be accurately generalized to the entire population.

The Future of Beauty is Personal

The rise of customized skincare is at the forefront of the beauty. Consumers are increasingly seeking products formulated specifically for their skin type, concerns, and environmental factors. Brands are leveraging data analytics and AI to offer bespoke skincare solutions. Makeup personalization is also becoming a standard, with foundation shades perfectly matching individual skin tones and lip colors that complement personal style. Virtual try-ons and AI-powered color matching tools are enhancing the consumer experience. Hair care is seeing significant personalization as well, with products tailored to hair type, texture, and specific needs such as moisture, volume, or color protection. Personalized hair care regimens are being created using consumer data and advanced algorithms. Meanwhile, the fragrance market is embracing personalization with bespoke scents crafted to individual preferences, and customizable fragrance kits and AI-driven scent recommendations are becoming popular among younger consumers.

The global personalized beauty market was valued at $38.9 billion in 2020 and is projected to reach $143.1 billion by 2030, growing at a compound annual growth rate (CAGR) of 13.8% from 2021 to 2030 (Allied Market Research, 2021). The broader consumer health and wellness market, which includes personalized beauty, is a $1.5 trillion market growing at 5-10% annually (McKinsey, 2021). According to Grand View Research (2023), the global personalized beauty products market size was valued at USD 38.0 billion in 2022 and is expected to expand at a CAGR of 7.6% from 2023 to 2030. Mordor Intelligence (2023) projects the personalized beauty market to reach USD 96.64 billion by 2028, growing at a CAGR of 7.47% during the forecast period (2023-2028). Additionally, the beauty tech market is expected to reach $8.93 billion by 2026, representing growth of over 102% compared to 2022 when it was valued at $4.41 billion (Arbelle).

In 2019, L'Oréal invested in Functionalab Group, a company offering personalized skincare and supplements. By 2022, L'Oréal's total sales reached €38.26 billion, marking an 18.5% increase (L'Oréal Annual Report, 2022). Estée Lauder acquired DECIEM, the owner of The Ordinary, for $1 billion in 2021, achieving net sales of $17.74 billion in fiscal 2022, a 9% rise (Estée Lauder Annual Report, 2022). Clinique's "Clinical Reality" campaign, utilizing AR for personalized skincare recommendations, led to a 20% increase in conversions and a 50% boost in customer engagement (Haptic Media, 2023). Prose, a personalized hair care brand, uses a 25-question quiz for product recommendations, serving over 1 million customers and experiencing 300% year-over-year growth (Beauty Independent, 2021). Research by Bolt indicates that 75% of shoppers are willing to pay more for personalized beauty experiences, with 72% of Gen Z consumers ready to pay over 10% extra (Bolt, 2023).

In 2024, where uniqueness is celebrated and individual needs are paramount, beauty has taken a decidedly personal turn. Today, consumers are not just seeking beauty products; they are on a mission for solutions meticulously tailored to their specific skin needs and aesthetic desires.

Global Google Trends Analysis: The Past 5 Years

Why Gen Z is Your Next Big Focus

Using Plural™, Wise Things' research and ad-testing proprietary platform, we surveyed a national panel of 613 youths aged 18-31. Learn more about Plural

“I wanted to buy one product that could solve my issues instead of buying multiple things that required research and effort to find.” - Anonymous

“I liked being able to see what skincare ingredients worked for my skin and what didn't!” - Anonymous

“For me, it’s important that brands offer diverse and inclusive products. It makes me feel seen when I purchase products that are meant to help me enhance and express my features.” - Anonymous

Throughout the survey, the dominant age group was consistently 20-22-year-olds, comprising at least 40% of the demographic. As more responses were collected, there was a noticeable shift in opinions on beauty and skincare spending habits, from occasional to weekly purchases. Additionally, the primary factor in purchasing decisions shifted significantly from price to brand reputation. The importance of personalization when purchasing beauty and skincare products decreased from an average rating of 10 to about 8 out of 10. Initially, most respondents had not purchased a product with a personalized shopping experience, but as more responses were collected, the majority indicated they had.

The data emphasizes the significant market for beauty and skincare products among Gen Z users, illustrating the importance of this research. This is shown through their frequent consumption of beauty products.

Key Insights:

Brand Reputation

Primary Factor: Brand reputation stands out as the top factor reported by survey respondents, underlining its crucial role in marketing and audience engagement. Examples: Brands like Milk and Glossier are trusted by consumers for their new product launches due to their strong brand reputations.

Social Media and Influencer Marketing

The role of social media and influencer marketing is highlighted, with PR packages sent to influencers and UGC creators demonstrating product usage and results.

Personalization

Data shows that survey respondents rate the importance of personalization at 8 out of 10, echoing the demand for customization and understanding of customers' unique needs and desires.

Affordability

Affordability is the second most important factor for respondents when purchasing beauty and skincare products.

100% of respondents consistently reported that they are willing to pay more for beauty and skincare products if they come with a personalized shopping experience. When asked how much more they would pay, responses shifted from $11-$20 more to $21-$30 more. Overall, respondents indicated they would pay up to 10-20% more for a custom and curated online shopping experience. When asked about the importance of diversity and inclusion in beauty and skincare brands, responses shifted from being extremely important to somewhat important. Initially, with fewer respondents, 100% were satisfied with the diversity and inclusion of the beauty and skincare brands they had already purchased from. However, as more responses were collected, only 82% of respondents expressed satisfaction with the diversity and inclusion of the brands they had purchased from.

The data emphasizes the significant market for beauty and skincare products among Gen Z users, illustrating the importance of this research. This is shown through their frequent consumption of beauty products. Brand reputation edges out as the top factor reported by survey respondents, highlighting its crucial role in marketing and audience engagement. Examples of brands with a strong reputation, like Milk and Glossier, demonstrate that consumers consistently trust their new product launches. The role of social media and influencer marketing is significant, with PR packages sent to influencers and UGC creators demonstrating product usage and results. Survey data shows respondents rating the importance of personalization at 8 out of 10, reflecting the demand for customization and understanding of customers' unique needs and desires. Affordability is the second most important factor in respondents' minds when purchasing beauty and skincare products. Amid increasing individualism seen in trends and aesthetics from social media such as cybersigilism punk, cottagecore, clean girl, and more, personalized beauty is becoming a top priority for Gen Z consumers when purchasing beauty and skincare products.

The biggest factor consumers look for when purchasing beauty and skincare products is brand reputation, followed by price and ingredients. The fact that brand reputation is the most considered factor supports the notion that Gen Z consumers are deeply invested in the diversity and inclusion of beauty and skincare brands, which also reflects the increase in individualism in today's society.

Brand Focus: Topicals

In our exploration of personalized skincare, we spoke with Sochima Mbadugha, VP of Strategy & Biz Ops at Topicals. Topicals is a beauty brand transforming the skincare experience with effective, science-backed products and a strong commitment to mental health advocacy. We asked Sochima, “What do you see as the biggest opportunities and challenges for skincare brands looking to offer truly personalized products at scale that resonate with different cultural values, traditions, and beauty ideals – both in terms of product development and marketing/customer experience?”

Sochima responded, “Skincare is rarely one-size-fits-all, so personalization allows brands to confidently claim efficacy based on an individual’s unique skin concerns. Brands like Curology have shown the effectiveness of these models, but even with personalization, customer satisfaction is not guaranteed. The inherent challenge of personalization is scaling it. It requires maintaining a larger number of SKUs in smaller quantities, making demand planning a nightmare. In regards to product development, any small tweak to a formula requires rounds of safety testing so in some ways it slows down your supply chain because you’re having to ensure efficacy on each variant of the formula before going to market. In short, it requires extensive investment without guarantee of ROI. However, if a brand has the capability to test and formulate efficiently then the opportunities are significant: market differentiation, increased customer loyalty, and valuable data insights, along with the ability to resonate with diverse cultural values and beauty ideals.”

AR/ML in Beauty

The global AI in beauty and cosmetics market is experiencing rapid growth, projected to soar from $2.68 billion in 2022 to $3.27 billion in 2023, and is expected to reach $6.8 billion by 2027. The beauty tech market is also set to expand significantly, aiming to hit $8.93 billion by 2026, doubling its size from 2022.

Beauty Boom: The global AI in beauty and cosmetics market is experiencing rapid growth, projected to soar from $2.68 billion in 2022 to $3.27 billion in 2023, with a continued upward trajectory expected to reach $6.8 billion by 2027. The beauty tech market is also set to expand significantly, aiming to hit $8.93 billion by 2026, doubling its size from 2022 (Report Linker, AI In Beauty And Cosmetics Global Market Report 2023).

Virtual Glam: Virtual try-on tools are revolutionizing customer engagement and boosting sales. Shoppers using these tools are much more likely to make a purchase, and brands implementing them see a substantial reduction in product returns.

Tech-Savvy Beauty: The market for smart beauty devices, such as AR mirrors, is growing impressively, with an annual growth rate of nearly 19%. This market is anticipated to reach $144.2 billion by 2028, reflecting a significant technological advancement in beauty routines (Vantage Market Research, Beauty Devices Markets 2022).

Eco-Beauty: AI and AR are driving sustainability in the beauty industry by cutting down on the need for physical product samples and reducing waste. Virtual try-ons and personalized recommendations are key contributors to more sustainable beauty practices.

—————————————————————————————

The AI in beauty and cosmetics market size is expected to grow from USD 3.9 billion in 2023 to USD 15.9 billion by 2028, at a CAGR of 32.5% (Markets and Markets).

Virtual Try-ons are a tool that has significantly boosted customer engagement and sales. Smart beauty devices, such as AR mirrors, are growing at an annual rate of 18.8%, and is expected to rise to $144.2 billion by 2028 (Arbelle).

AI and AR are contributing to more sustainable practices in the beauty industry by reducing the need for physical product samples and minimizing waste through methods mentioned above.

Brand Focus:

KIKI World

In our exploration of personalized skincare, we spoke with Jana Bobosikova, Co-Founder of KIKI World. KIKI World leverages AI and blockchain technologies to involve customers directly in the creation and voting process of beauty products, ensuring the final offerings precisely match consumer preferences.

In our conversation with Jana Bobosikova, she highlighted the challenges brands face with scalability and cost-effectiveness when offering personalized beauty products on a large scale. Jana explained, "Finding the right partners is crucial. It is no longer true that all products are dramatically cheaper to produce at massive scale. Thanks to improvements in supply chain technologies, additive manufacturing, and robotic small batch compounding, scalability and personalization are no longer opposite sides of the spectrum of growth, profitability, and success. It’s not what some of the large manufacturers with legacy, expensive infrastructure and extensive lead times will admit, but KIKI is proof that startup disruption is possible. We can produce what people want and reward them for input, not just for what they buy. It’s time to build something new, this time all together. Notably, this process also leads to an incredible pace of innovation, as demonstrated by the pipeline of our network, where we're sneak peeking the Future Face campaign."

Discussing the key factors driving personalization in beauty and their future evolution, Jana noted, "Front-end customization, such as online or in-store questionnaires and custom usage protocols or shade matching, is a ubiquitous business practice, an enormous source of loyalty, and a key component of building a healthy business. What’s newer is end-to-end customization, enabled by agile, additive manufacturing, leveraging predictive models for formulation, and truly customizing for a customer or a cohort. What’s unique and what we’re doing with KIKI, in addition to the above, is the co-ownership of the data involved by leveraging blockchains. This approach, building a network of data accessible by customers and creators, can transform the value chain and accelerate innovation across customer, creator, and product technologies and materials."

On the topic of promising technological advancements, Jana highlighted, "AI enhancing the way we formulate products or discover and compound new molecules is incredibly exciting and a huge opportunity for the personal care category at large. AR, especially in social apps, is informing the aesthetic of many trends, and VR is exciting but largely yet untapped. That said, these technologies are currently adopted largely through fairly centralized corporate networks en masse, and it’s unclear whether they will lead to customization or perhaps the opposite in the short term, while ultimately unlocking personalization in the long term."

Brand Focus:

Slate Brands

In our interview, Judah, CEO of Slate Brands, explained, “We leverage advanced technologies to tailor our beauty solutions to the preferences of today’s youth by gathering data from various sources, including competitor analysis, trend forecasting, in-house brand metrics, talent brand metrics, market research, and data scraping. This comprehensive approach helps us stay informed about trends and make well-informed decisions regarding our products and strategies.” He acknowledged the challenges of the highly competitive beauty industry, stating, “Despite the crowded market, our data-driven model allows us to transfer insights seamlessly across different business areas, helping us adapt quickly to technological advancements while ensuring our products remain effective and compatible.”

Regarding customer feedback, Judah emphasized its importance: “Customer feedback is crucial in shaping our personalized beauty products. We continuously collect and analyze feedback to gain a deeper understanding of consumer preferences, needs, and expectations.” He added, “This feedback is integral to our product development process, allowing us to make informed adjustments and innovations. Effective communication between our Data and Product teams ensures that feedback is integrated into our development process, enabling us to work on accelerated timelines and bring products to market that truly resonate with our customers.”

Influencer Marketing

Focusing on the youth demographic, brands have strategically tailored their marketing efforts, with 82% of campaigns targeting individuals aged 20-29 and 77% focusing on those aged 30-39 (Influencer Intelligence). This personalized approach highlights the industry's commitment to capturing the attention and loyalty of younger consumers, who are pivotal in shaping market trends. The financial investment in influencer marketing underscores its growing importance. In 2024, 34% of marketing budgets are projected to be allocated to influencer campaigns, with 16% planning to invest between 30% to 49% (Influencer Intelligence). This allocation signifies the trust marketers place in influencers' ability to drive brand engagement and consumer conversion. Content creation remains a critical aspect of influencer marketing. A significant 57% of marketers rely on influencers to generate content for their channels, and 33% have found success by granting influencers creative freedom (Influencer Intelligence). This approach not only fosters authenticity but also aligns with the preferences of younger audiences who value genuine, relatable content. Instagram continues to dominate as the leading platform for influencer marketing, with 54% of marketers reporting the most success in 2023. However, TikTok is rapidly emerging as a formidable contender, with 28% of marketers achieving success and 44% planning increased investment in 2024 (Influencer Intelligence). This shift highlights the evolving landscape of social media platforms and their impact on influencer marketing strategies.

Looking to the future, purpose-driven campaigns are expected to play a crucial role, with 76% of marketers emphasizing their importance for customer connection. Furthermore, 85% predict a rise in video and audio content partnerships, reflecting the shifting consumer preferences towards more engaging and dynamic content formats (Influencer Intelligence). Brands have adeptly harnessed these trends by collaborating with influencers on sponsored content and exclusive product lines, fostering a sense of scarcity and novelty. This strategy accelerates consumption cycles, as Gen Z rapidly adopts and discards personalized beauty trends (Mardon et al., 2018). Influencers advocate for the personalization of beauty regimens through trial and error, driving excess purchasing behaviors and brand loyalty (Barlido et al., 2021). Social media influencers are now the primary source of information about beauty products for younger consumers. According to Forbes, younger consumers prefer to seek personal responses from influencers online. The influencer marketing industry is projected to reach a valuation of $22.2 billion by 2025, underscoring its effectiveness and the increasing investment from marketers (Rockpaperreality). TikTok and Instagram remain the dominant platforms for influencer partnerships, essential for reaching Gen Z and Gen Alpha audiences. Authentic content and long-term collaborations resonate deeply with these demographics, who prioritize genuine recommendations and reviews. Influencers' use of affiliate links and storefronts on platforms like Amazon and TikTok further streamline the purchasing process, enhancing consumer convenience.

Successful campaigns, such as Emma Chamberlain's promotion of Curology and Clinique's micro-influencer initiatives, demonstrate the impact of influencer marketing on brand awareness and consumer purchasing intentions (Tumblr; Territory Influence). Milk Makeup's engagement with user-generated content creators showcases the power of community connection through influencer collaborations.

The rise of influencer entrepreneurship in the beauty industry has been prominent across social media, with brands like Summer Fridays, Sacheu Beauty, Rhode, One/Size, Patrick Ta, and Ouai all created by influencers. The success of these influencer beauty brands highlights the power of personal branding in marketing. Each influencer brings a unique personality and brand, effectively communicating with their audience and helping to build a strong community around their products.

Studies show Gen Z is heavily influenced by social media in their purchasing decisions, with 44% citing influencer recommendations as their top source for beauty inspiration (MacDonald, 2021). The pandemic accelerated the adoption of digital tools for personalization, driving significant market growth. Social media encourages customers to share their personalized beauty experiences, generating authentic user-generated content that resonates with potential customers. Platforms like Instagram and Snapchat offer AR filters that enable users to virtually try on makeup or hairstyles.

Social media serves as a real-time focus group for beauty brands, helping them identify emerging trends and consumer preferences.

The rise of “skinimalism”/ “clean girl” as a beauty trend was largely driven by social media discussions.

Allows personalized beauty brands to build communities around their products.

Glossier, known for its personalized approach, has built a community of over 3 million followers on Instagram.

Social commerce features on platforms like Instagram and Facebook allow personalized beauty brands to sell directly to consumers.

Social media serves as a platform for real-time customer service and feedback collection.

According to Sprout Social, 77% of consumers are more likely to buy from a brand they follow on social media

Personalization in Motion

Drivers of Personalization in Beauty

Technology and Innovation

Advancements in technology, such as AI, machine learning, and data analytics, are enabling brands to offer personalized beauty solutions at scale. These technologies help in understanding consumer preferences and creating products that meet their specific needs.

Consumer Demand

Today's consumers, especially Gen Z and Millennials, prioritize individuality and self-expression. They expect products that resonate with their personal identity and lifestyle. This shift in consumer behavior is driving brands to focus on personalization.

Health and Wellness

There is a growing awareness about the importance of health and wellness in beauty. Personalized products that cater to individual health needs and promote overall well-being are gaining traction. Consumers are looking for clean, safe, and effective products.

Sustainability and Ethics

Personalization also aligns with the values of sustainability and ethical consumption. Customized products reduce waste and promote responsible use of resources. Brands that emphasize sustainability in their personalized offerings are more likely to attract young, conscious consumers.

What's Next?

Leveraging Social Media and Influencer Marketing

Brands can start to utilize social media platforms such as TikTok and Instagram to leverage their reach. By employing marketing strategies like influencer marketing, they can target the Gen Z audience with authentic reviews of personalized beauty products and recommendations. Influencers provide a relatable and trustworthy voice that resonates with this demographic, making personalized products more appealing.

Prioritizing Diversity, Authenticity, and Affordability

Existing studies and our research highlight the importance of diversity, authenticity, and affordability for brands looking to resonate with progressive Gen Z consumers. This generation values individualism and uniqueness, and brands that prioritize these elements in their marketing and product development are more likely to succeed. Transparent communication and inclusive product lines foster trust and loyalty among young consumers.

The Importance of Personalization and Community

Personalization and community have become increasingly important to consumers. Brands like Saie Beauty exemplify this by hosting events for influencers and community members, where they provide personalized product selections and master classes on product usage. These curated events not only highlight brand inclusivity but also allow consumers to connect with the brand in a meaningful way. This educational aspect strengthens the bond between the brand and its community, showcasing the importance of personalized experiences.

Collaborative Efforts for Enhanced Consumer Engagement

Emphasis on community is crucial, and brands should explore collaborations with other brands to deliver thoughtful experiences and products that resonate with shared audiences and values. For example, the collaboration between Inn Beauty and Poppi lip oil demonstrates how brands can merge their communities and offer unique, personalized products that appeal to both audiences.

Market Trends: Moving Forward

The market for personalized beauty products is progressing. Brands like Ulta are enhancing their efforts to create personalized skincare and beauty products through strategies like personalized online quizzes. These quizzes assess skincare needs and match consumers to suitable products, allowing brands to participate in the personalized beauty industry even without custom products. Brands like Bulldog Skincare are advancing the market with AI analysis, providing refined methods for analyzing consumer skin types and needs. This technological approach allows brands to offer better-tailored products. Conversely, brands like Curology are falling behind by not offering personalized shopping experiences, as consumers must rely on their knowledge to select products, reducing the personalized aspect of their service.

Consumer Perspective

Consumers want to interact with brands to connect with the communities the brands cultivate. They seek connections with people who share their values and interests and enjoy showcasing their own through the products they use. Personalized beauty allows consumers to form individualized routines that express their authentic selves on social media and in everyday life.

The Future of Personalized Beauty

The beauty and skincare market is trending towards increased personalization. This trend is driven by consumer demand for tailored experiences, technological advancements that enable scalable customization, and the competitive advantage personalization offers brands. This aligns with broader personalization trends across various industries, indicating a continued focus on individualized products and services in the future. To capitalize on this wave of personalized beauty, brands need to listen to their communities and create curated experiences for their consumers. Improving marketing strategies through influencer marketing and utilizing AI and AR analysis tools can attract Gen Z consumers to personalized beauty and skincare brands. The future of the market looks bright for those who embrace personalization and foster strong consumer connections.

The rise of customized skincare is at the forefront of the beauty. Consumers are increasingly seeking products formulated specifically for their skin type, concerns, and environmental factors. Brands are leveraging data analytics and AI to offer bespoke skincare solutions. Makeup personalization is also becoming a standard, with foundation shades perfectly matching individual skin tones and lip colors that complement personal style. Virtual try-ons and AI-powered color matching tools are enhancing the consumer experience. Hair care is seeing significant personalization as well, with products tailored to hair type, texture, and specific needs such as moisture, volume, or color protection. Personalized hair care regimens are being created using consumer data and advanced algorithms. Meanwhile, the fragrance market is embracing personalization with bespoke scents crafted to individual preferences, and customizable fragrance kits and AI-driven scent recommendations are becoming popular among younger consumers.

The global personalized beauty market was valued at $38.9 billion in 2020 and is projected to reach $143.1 billion by 2030, growing at a compound annual growth rate (CAGR) of 13.8% from 2021 to 2030 (Allied Market Research, 2021). The broader consumer health and wellness market, which includes personalized beauty, is a $1.5 trillion market growing at 5-10% annually (McKinsey, 2021). According to Grand View Research (2023), the global personalized beauty products market size was valued at USD 38.0 billion in 2022 and is expected to expand at a CAGR of 7.6% from 2023 to 2030. Mordor Intelligence (2023) projects the personalized beauty market to reach USD 96.64 billion by 2028, growing at a CAGR of 7.47% during the forecast period (2023-2028). Additionally, the beauty tech market is expected to reach $8.93 billion by 2026, representing growth of over 102% compared to 2022 when it was valued at $4.41 billion (Arbelle).

For younger consumers, customized beauty formulas and packaging are incredibly appealing. The vast array of products available online can make finding the right one frustrating and time-consuming. This report, featuring zero-party consumer data and expert opinions, explores how the desire for personalized beauty is driving significant interest in custom beauty products among younger consumers.

For younger consumers, customized beauty formulas and packaging are incredibly appealing. The vast array of products available online can make finding the right one frustrating and time-consuming. This report, featuring zero-party consumer data and expert opinions, explores how the desire for personalized beauty is driving significant interest in custom beauty products among younger consumers.

Brought to you by

For younger consumers, customized beauty formulas and packaging are incredibly appealing. The vast array of products available online can make finding the right one frustrating and time-consuming. This report, featuring zero-party consumer data from 613 youths and expert opinions, explores how the desire for personalized beauty is driving significant interest in custom beauty products among younger consumers.

Brought to you by

Authors: Onanma Okeke, Saloni Bonde, Wendy Qian, Noemi Morales, and Mary Ngo

Brought to you by

Corvane is an AI-powered consumer and market intelligence platform that empowers you to create brands, ads, products, and shopping experiences that people love. Our commitment extends to providing our research and ad-testing proprietary platform built from the ground up.

BeautyMatter is an essential daily resource for industry insiders who demand the most current beauty intelligence. An essential resource for insiders filling the void, connecting the dots, and providing a perspective that is informed, analytical, and has a compelling point of view. We help leaders stay connected and informed in a constantly changing world.

decisions.

Introduction

Consumers now have the opportunity to participate in creating products uniquely tailored to meet their individual needs and preferences. This gravitation towards more customer-based solutions allows consumers to be a part of the process, increasing their attachment to the products they help create. The beauty industry is undergoing a shift towards personalization, driven by the evolving preferences of the younger generation. As technology advances and consumer expectations change, the future of beauty is becoming increasingly personal. This report explores the trends, drivers, and implications of this transformation using zero-party data from 613 individuals in the USA aged 18-31. Is the future of beauty personal?

Market Shifts: The beauty industry is adapting to meet the demand for personalized products, influencer marketing and product development strategies. In a world where most things are mass-produced, individualism is becoming increasingly important.

Sustainability: Customized products can reduce waste, appeals to environmental concerns amidst climate crisis.

Consumer Involvement: When customers are involved in the process, they develop a stronger attachment to the product, which becomes a reflection of their own identity. This is especially significant in a market characterized by fast product cycles and the impersonal nature of mass production. Personalized beauty is not just a trend; it is a fundamental shift in how products are created, marketed, and consumed. Young consumers are seeking products tailored to their unique needs, preferences, and identities. This demand for customization is reshaping the industry, pushing brands to innovate and adopt new technologies to stay relevant.

Embracing Diversity: The beauty industry is evolving to address diverse, previously unmet consumer needs. Product diversity and inclusivity are now crucial, encompassing various skin colors, hair types, and specific conditions. This broader representation validates consumers across different demographics, fostering a sense of acknowledgment and belonging. As a result, inclusivity has become both an ethical imperative and a key factor in brand success.

The beauty industry is experiencing a significant transformation driven by the demands of younger consumers, particularly Gen Z. These consumers are seeking highly personalized and unique experiences across skincare, makeup, and haircare, actively participating in the co-creation of products tailored to their specific needs and preferences. This shift towards customization and active consumer involvement is being facilitated by technological advancements, enabling brands to offer increasingly personalized solutions. As a result, the future of beauty is becoming more individualized, with tech-driven personalization at its core. This is reshaping various aspects of the industry, from product development and marketing strategies to retail experiences and brand loyalty. Companies are likely to adopt more flexible production processes, interactive marketing approaches, and data-driven personalization techniques to meet these evolving consumer expectations. The movement towards personalization not only presents challenges for beauty brands but also offers significant opportunities for those able to successfully adapt to this new landscape, potentially gaining a competitive edge in the market.